Key Takeaways

- Australia’s electricity generation and grid infrastructure will expand rapidly under Labor. Meanwhile, the Coalition’s cap on renewables and delayed nuclear rollout risks underinvestment, grid stagnation and potential power shortfalls by the mid-2030s.

- Labor backs critical minerals and battery supply chains, while the Coalition supports coal, gas and uranium extraction, easing approvals to stimulate traditional resource exports and long-term nuclear readiness.

- Heavy industry and manufacturing gain decarbonisation funding under Labor’s Future Made in Australia. In contrast, the Coalition will redirect funds towards broader priorities, reducing support for green industrial innovation and low-emissions steel, cement and materials production.

- Oil and gas extraction benefits from Coalition policies like the National Gas Plan and reservation scheme, while Labor favours electrification, eventually phasing down domestic demand despite strong export market prospects.

- The transport and construction sectors stand to benefit from Labor’s EV incentives and renewables infrastructure buildout. At the same time, the Coalition’s focus on gas and future nuclear may limit short-term growth in clean transport and regional energy construction.

The 2025 election is a sliding-door moment for the Australian energy production landscape. With two vastly different approaches to combating energy prices and emissions targets, Labor and the Coalition will go to the ballot promoting their plans as the most beneficial for the Australian people.

The energy transition is not just a political issue. How it plays out will significantly impact large swathes of the Australian economy, shaping sectors like Manufacturing, Transport, Education and Training, Professional, Scientific and Technical Services, Mining and Electricity, Gas, Water and Waste Services.

Companies will need to analyse, at both the sector level and the industry-specific level, how these differing policies may impact them along with their upstream and downstream markets if they're to have any chance of successfully navigating a rapidly changing operational environment.

Where does Australia’s energy transition stand today

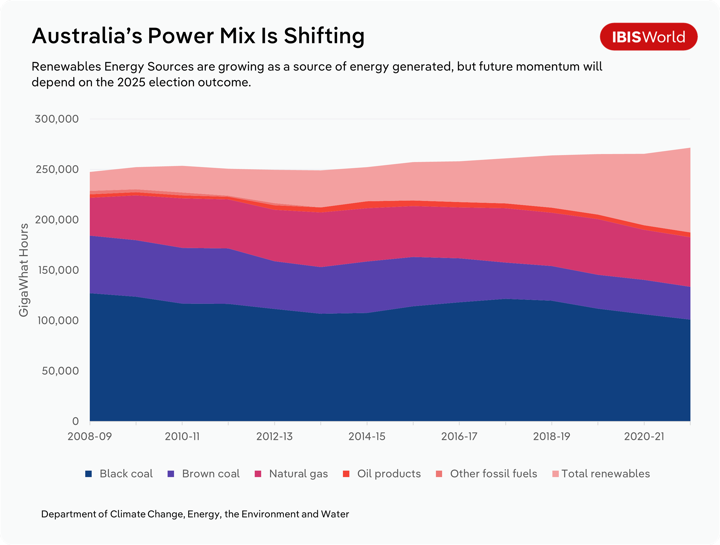

The current Federal Labor Government’s energy policy mirrors what it is taking into the election. A growing dependence on renewables, including rooftop solar, wind power and hydroelectric, like the Snowy Hydro 2.0 project, has been pushed with rebates for households and subsidies for companies expanding their generation capacity. South Australia's ability to produce 70% of its required power from renewables is a testament to Australia’s potential as a green energy superpower.

Despite the clear example of the capabilities of non-fossil-fuel energy generation as a power source, there has been pushback across the country. Wind farms have long been protested as some residents believe they can have adverse health impacts and destroy landscapes; hydro-power brings many of the same issues as damming a river, while nuclear power, spruiked by the Coalition as the future of Australian energy, experiences the most significant opposition.

Regardless of improvements in reactor design and safety measures, the impacts of Fukushima, Chornobyl and Three Mile Island remain in people's minds, leaving them rightfully cautious about the legitimacy of the energy source, particularly in a country with abundant wind and solar energy capacity.

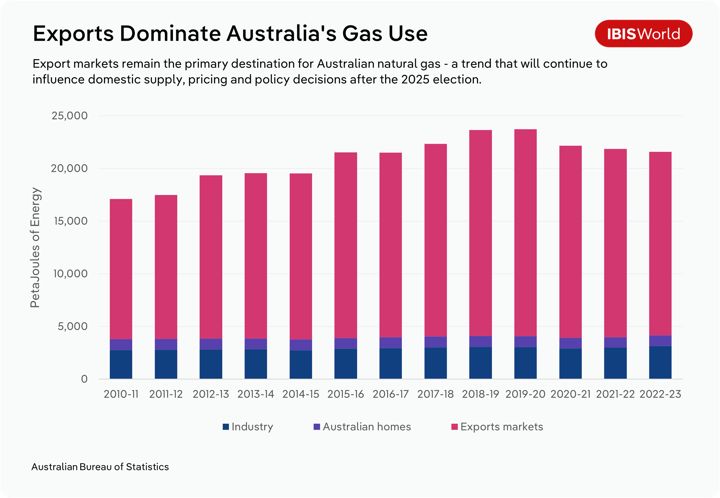

While renewable energy is making up an ever-growing portion of Australia’s electricity grid, the reliance on coal and gas-powered plants for baseload power has exposed the country to fluctuations in global market prices. Notably, the Russian invasion of Ukraine caused energy costs to skyrocket worldwide, and Australia’s current system of exporting natural gas only to buy it back at export prices means that households faced dramatic climbs in energy costs despite being a major fossil fuel producer. It stands to reason that both parties have pushed the cost and security of energy as key election topics, with both the Coalition and Labor pointing fingers at one another with claims of inefficiency and higher expense.

Both major parties have committed to a net-zero economy by 2050, although only Labor has accompanied this with 2030 and 2035 targets as well. Much of the Coalition’s hopes of hitting their target rely on the viability of and ability to construct nuclear power plants in the medium-term, which currently faces significant legislative opposition.

Labor

Regarding immediate impact, Labor’s investment into renewables and the infrastructure required to connect them to the grid is leading the way. According to Environment Minister Tanya Plibersek, the government has approved over 77 new renewable energy projects since being elected in 2022, providing enough energy to supply every home in the country.

Over this period, the Labor Government has made significant financial commitments to advancing the renewable energy transition, including:

- $22.7 billion over a decade to bolster domestic manufacturing in sustainable energy sectors, including $6.7 billion and $7 billion to renewable hydrogen production and critical minerals processing and refining respectively.

- $1 billion to support the domestic manufacturing of solar panels, helping to reduce the reliance on imports while also creating local jobs.

- $20.5 billion to drive investment across areas of the economy critical to the clean energy transition

- $15 billion to support hydrogen production and critical minerals processing.

Coalition

The Coalition's plans and proposals are significantly different. It appears the party has placed nuclear energy at the centre of its long-term power plan, with the idea of nuclear energy being the only viable solution for Australia’s energy needs while acknowledging that it will be years until reactors are online and supplying electricity. In the years leading up to this tipping point, the Coalition believes that gas and coal will do the heavy lifting, remaining the dominant power source for the nation and making any emissions commitments very difficult to meet.

Certain mining industries, like Black Coal mining, Brown Coal mining and Oil and Gas Extraction, will fare better under this plan as domestic demand remains high. This is especially true given that other countries worldwide are pivoting away from these fossil fuels, potentially cutting into export demand for the resources.

What this means for industry

Electricity generation and transmission

Labor majority government

Under a Labor-majority government, the Solar Electricity Generation and Wind and Other Electricity Generation industries will continue receiving significant aid. This will accelerate their rollout and uptake, driving up revenue and profit margins as they achieve economies of scale and complete the transmission upgrades required for their use.

With the continued integration of renewable energy sources and battery technology into the grid, the Electricity Transmission industry would receive significant federal funding to roll out upgrades and expand the network. To facilitate the rapid rollout of these improvements, regulatory approvals will be streamlined and investment into skilled labour will be crucial if the ambitious infrastructure goals are to be met.

Coalition majority government

Under the coalition, the funding and emphasis on renewable energy generation would likely diminish as the party’s modelling on nuclear energy assumes renewables will make up no more than 54% of the grid by 2050. If the current funding and build rate was to remain, this number would be well surpassed, therefore implying a reduction in efforts to construct renewable energy sources. If this comes to fruition the Solar Electricity Generation and Wind and Other Electricity Generation industries would naturally be significantly impacted, potentially leading to a loss of 42,000 jobs by 2030.

The Dutton-led party has proposed ending Labor’s Rewiring the Nation Fund, which aims to modernise the Australian grid and provide thousands of jobs across multiple states. Without this act, the Electricity Transmission industry would suffer dramatically, as the proposed sites for nuclear reactors and continued use of existing coal-fired plants would necessitate far less transmission construction than an expanded renewable network based in regional and remote parts of the country.

How to prepare your business

- Companies directly in or in business with solar, wind, hydro and battery storage companies should prepare for rapid expansion under a Labor government by securing capital, skilled staff and shoring up supply chains.

- Grid infrastructure firms must position themselves for federal-backed contracts by understanding energy rollout priorities and ensuring they meet the sustainability requirements that a Labor government would require.

- Under a Coalition government, businesses tied to renewables should brace for reduced domestic demand, instead looking to expand battery storage for the possibility of export markets.

- Coal mining and gas extraction firms should obtain secure funding in preparation for a coalition government ramping up the use of fossil fuels in the electricity grid.

Mining

Labor majority government

The mining sector will see substantial changes with a Labor majority government. Companies concentrating on fossil fuels, like those in the Coal Mining and Oil and Gas Extraction industries, would face significant threats to domestic demand. Labor has left the door open for mining for export markets for these industries, which could keep them viable.

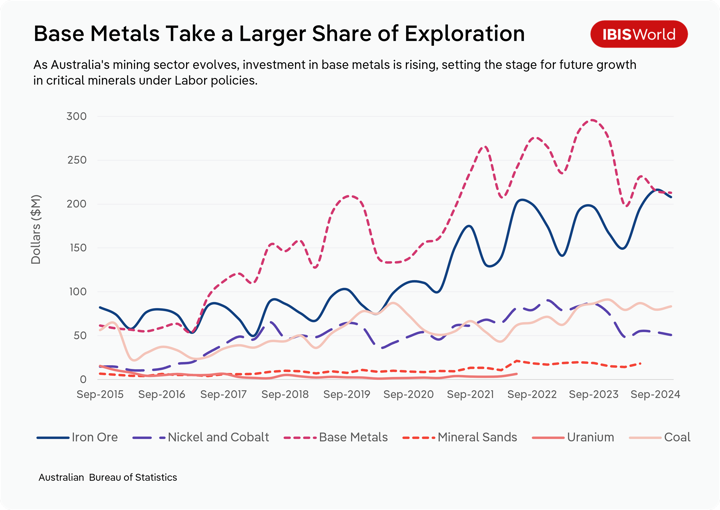

On the other hand, the Lithium and Non-Metallic Mineral Mining industry could see rapid expansion as the Future Made in Australia Act comes into full swing, funding exploration for critical minerals needed for the energy transition. Gold and Other Non-Ferrous Metal Processing would also see significant investment as the Government attempts to expand the country's economic complexity and moving up the value chain by expanding processing capabilities like converting spodumene into lithium hydroxide.

Coalition majority government

The Coal Mining and Oil and Gas Extraction industries would receive support from a Coalition government by way of accelerated approvals and reduced regulatory barriers, allowing them to build out new projects and sustain valuable export markets.

While the opposition has acknowledged the importance of critical minerals, it has yet to propose an equivalent policy to the Future Made in Australia Act. As a result, growth in the Lithium and Non-Metallic Mineral Mining industry may slow, limiting downstream processing investment.

How to prepare your business

- Critical minerals miners should accelerate project readiness and exploration plans in anticipation of Labor grants and support. This is especially true for minerals that both parties have recognised as critical.

- Coal and gas producers may benefit under the Coalition by should plan for reputational and ESG pressures in export markets.

- Lithium processing firms and mineral and metal value-add should seek partnerships and government engagement to take advantage of Labors industrial policies.

Heavy industry and manufacturing

Labor majority government

The manufacturing sector will be forced to transition rapidly, moving away from high-emissions production methods like iron smelting and cement manufacturing. Green steel manufacturing will receive significant support under the Future Made in Australia Act, positioning Australia as a leading exporter of low-emission materials.

In addition, manufacturers involved in renewable energy inputs like battery casings, solar panel frames or electrolyser components—could benefit from new grants and procurement contracts as the government prioritises local content in energy infrastructure.

Coalition majority government

With no equivalent policies promoting decarbonisation, heavy manufacturing under the Coalition may fall behind international benchmarks. This could impact global competitiveness, especially as trade partners begin to favour sustainable materials.

However, traditional manufacturers reliant on fossil fuels for energy or process heat may benefit in the short term from looser emissions standards and less pressure to electrify operations, preserving current cost structures.

How to prepare your business

- Manufacturers should assess emissions footprints and explore lower-carbon production methods to align with Labor’s policy direction.

- Green steel producers should pursue expansion and funding opportunities tied to federal support programs.

- Firms supplying materials to the renewable energy supply chain should position themselves for potential procurement advantages under Labor.

- Under a Coalition government, manufacturers reliant on fossil fuels may enjoy short-term stability but should not defer long-term transition planning.

Oil and gas extraction

Labor majority government

Labor views gas as a temporary transition fuel. While gas remains necessary in the short term to stabilise the grid, long-term demand is expected to slump as households are incentivised to electrify their heating and cooking systems. Strong export markets may offset domestic demand reductions, but the long-term outlook is negative.

Additionally, Labor has proposed new regulatory scrutiny on new gas fields and pipelines, particularly in environmentally sensitive areas, which may raise approval risks and development timelines for exploration firms.

Coalition majority government

The Coalition has proposed a National Gas Plan to protect the domestic gas supply, cut household energy costs and support producers with infrastructure funding and rebates. This strategy would provide a strong operating environment for the entire supply chain of the Gas Extraction industry, from exploration companies through to producers and transport infrastructure players.

The Coalition’s support for maintaining gas as a key fuel source in electricity generation and its opposition to electrification mandates could result in stronger long-term domestic demand than under Labor.

How to prepare your business

- Gas suppliers should build export resilience under Labor and invest in demand-side flexibility to respond to falling domestic use.

- Under the Coalition, gas producers would be able to take advantage of infrastructure and rebate programs to expand capacity.

- Exploration and midstream firms should monitor environmental policy settings closely under Labor to anticipate potential project delays.

- Across both outcomes, firms should factor in long-term risks from international decarbonisation trends and ESG funding requirements.

Transport and construction

Labor majority government

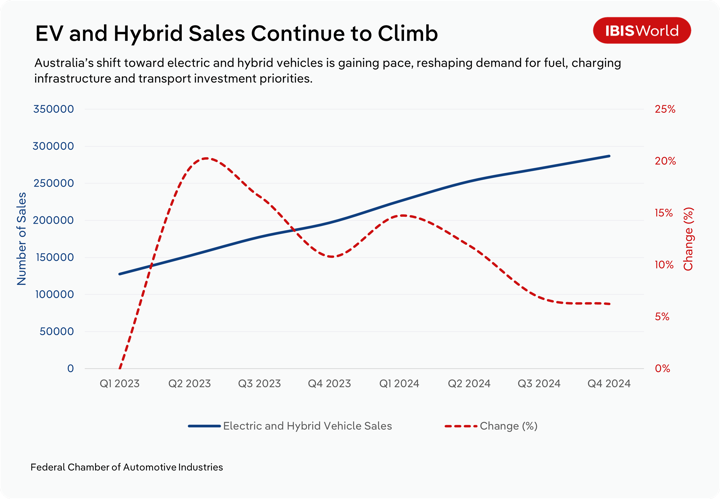

Labor-promoted incentives for electric and hybrid vehicles are expected to reduce fuel demand, harming petroleum refiners and retailers while providing an opportunity for households to charge their cars with household solar. The transition will allow the Fuel Retailing industry to pivot away from petroleum products and towards EV charging.

Construction firms, particularly those involved in renewable energy projects and grid upgrades, stand to benefit from large-scale public contracts for solar farms, wind farms, hydroelectric projects and transmission lines.

Labor’s policies may also accelerate investment in electric vehicle charging infrastructure and public transport electrification, creating opportunities for civil contractors and infrastructure consultancies in urban centres.

Coalition majority government

With no strong focus on EV adoption, internal combustion vehicle use may persist longer, supporting the status quo for the Fuel Retailing industry.

Construction firms may benefit from gas infrastructure or, in the longer term, nuclear plant developments, though these projects have longer timelines and regulatory hurdles and have highly specific demands that few, if any, Australian firms have extensive experience in.

The Coalition may prioritise road and transport infrastructure over emissions-reduction projects, leading to higher demand for firms with capabilities in traditional civil engineering and bulk earthworks.

How to prepare your business

- EV charging providers and clean transport suppliers should scale up under Labor, while fuel retailers must prepare for demand erosion of their traditional product and service offering.

- Construction firms should align capabilities with renewable energy projects under Labor, or gas/nuclear projects under the Coalition.

- Firms in EV infrastructure and rail electrification should seek partnerships and tenders linked to Labor’s clean transport plans.

- Businesses across transport infrastructure should track federal procurement pipelines closely, as each government investment focus shifts by government.

Final Word

The 2025 Australian federal election presents a sliding doors moment for the nation's energy and industrial sectors, with each major party proposing distinct policy directions that will shape the economic landscape.

Under a Labor Government, a continued and expanded focus on renewable energy, supported by initiatives like the Future Made in Australia policy, will drive investment into sustainable industries, including solar and wind energy and critical minerals processing, capturing aspects of the value chain that Australia does not yet benefit from. This approach fosters long-term economic growth and job creation in emerging sectors at the expense of significant spending.

A Coalition Government would emphasise traditional energy sources, with plans to extend the life of coal-fired power plants and explore nuclear energy options. While this may provide short-term energy stability, analyses suggest potential challenges, like electricity shortages because of ageing infrastructure and the lengthy timelines associated with nuclear power development that could potentially blow out from current estimates.

In this period of potential transformation, proactive planning and adaptability will be crucial for businesses to navigate the evolving energy landscape and harness emerging opportunities.