Key Takeaways

- Australia is grappling with a surge in business failures and B2B payment defaults, driven by rising borrowing costs and increasing operating expenses.

- Vulnerable sectors like food and beverage services are feeling the pinch, with insolvency rates rising due to shifting consumer spending and escalating operational costs.

- To weather economic volatility, businesses should focus on robust financial management, risk assessment and market diversification to mitigate threats and enhance stability.

- Banks and financial professionals face growing challenges as business failures surge, requiring astute risk management and innovative lending strategies.

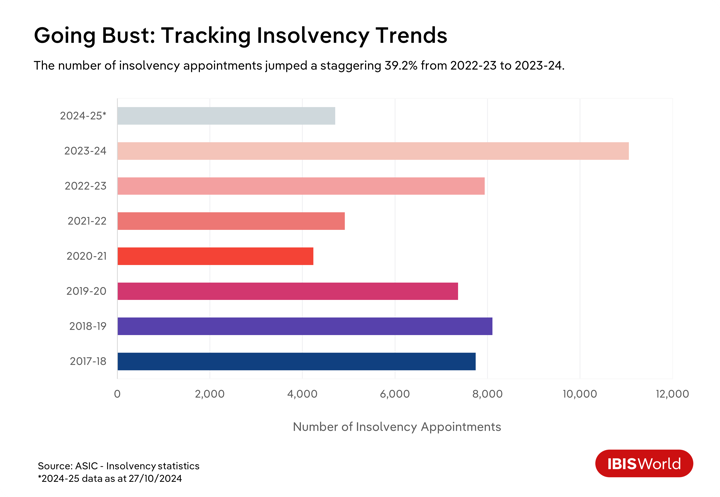

Business failures in Australia have surged in 2024, with the failure rate increasing by 17.3% since January, leaving many companies grappling with the harsh realities of an evolving economy. Moreover, figures from the Australian Securities & Investments Commission reveal that there have been 4,710 insolvency appointments in 2024-25 up to the end of October.

The Australian economy is grappling with several challenges that are driving business failures and B2B payment defaults. Rampant inflation over the three years through 2023-24 prompted the Reserve Bank of Australia to tighten monetary policy aggressively, leading to multiple interest rate hikes from May 2022 through to the latest hike in November 2023.

Even though the cash rate has since stabilised and the consumer price index fell within the RBA’s target band over the year to the first quarter of 2024-25, elevated borrowing costs are still a burden for businesses. These conditions constrain cashflows and complicate servicing existing debts. Meanwhile, consumers dealing with heightened mortgage payments are reducing their expenditure on non-essential goods, which poses additional challenges for consumer-reliant businesses.

Shifts in consumer spending patterns and negative consumer sentiment in recent years are adding to pressures. Consumers are becoming more cautious, with essential goods and services like housing, food and energy taking up a larger share of household budgets. This shift means businesses in sectors like discretionary retailing and hospitality are particularly vulnerable. Companies that can't adapt to changing consumer preferences or maintain profit margins amid increased discounting may struggle to remain viable.

For instance, in February 2023, fashion retailer Alice McCall entered liquidation, highlighting the financial vulnerabilities faced by businesses dependent on discretionary spending. The brand suffered from reduced consumer expenditure on fashion and apparel, a situation worsened by persistent economic challenges and a failure to recover from a slump caused by the COVID-19 pandemic. With debts exceeding $1.0 million, Alice McCall's situation underscores the growing correlation between business failures and B2B payment defaults, which have reached unprecedented levels with a staggering 68.1% hike over the past year.

Businesses are also facing a "cost-of-doing-business crisis" alongside the consumer cost-of-living challenges. Mounting input costs in response to inflation, higher wage pressures in a relatively tight labour market and increased energy and transportation expenses are squeezing profit margins. For many businesses, especially small and medium-size enterprises, these mounting costs are outpacing their ability to raise prices, leading to liquidity issues. These factors are contributing to a rise in B2B payment defaults. Cashflow pressures make it difficult for businesses to meet their payment obligations, creating a risk of a domino effect through supply chains as business failures rise.

Addressing these mounting challenges is imperative for maintaining economic stability. Ignoring these issues could lead to significant financial repercussions across supply chains and hinder the Australian economy’s overall recovery and growth potential in the post-pandemic era. To navigate these turbulent times, businesses must adopt robust financial management strategies, enhance their risk management practices and strengthen stakeholder relationships to mitigate threats and ensure long-term economic resilience.

Struggling sectors in the spotlight

Food and beverage services

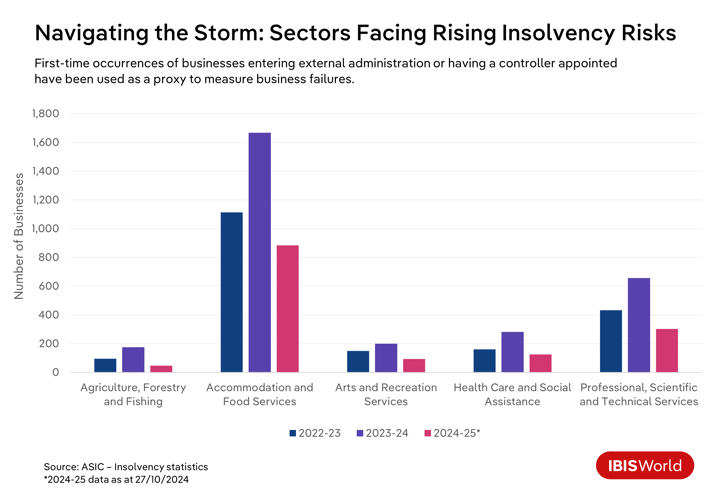

Over the past few years, numerous businesses have faced challenges to surviving in Australia, with specific industries bearing the brunt of these difficulties. The food and beverage services sector, in particular, has witnessed a spike in insolvency rates over the year to October.

Restaurants and cafes are grappling with mounting operational costs and reduced consumer spending, driven by a broader cost-of-living crisis that has consumers tightening their belts. This financial strain is further exacerbated by the Australian Taxation Office's aggressive efforts to reclaim tax debts, which are disproportionately affecting small businesses within this sector.

Arts and recreation services

The arts and recreation services sector is in a similar boat, where negative consumer confidence and mounting costs have contributed to higher insolvency rates. The cost-of-living crisis has forced consumers to cut back on discretionary spending on entertainment, cultural events and recreational activities, weighing on revenue for these businesses. This subdued demand is further strained by increased expenses like utilities, insurance, rent and the need to comply with health and safety regulations, which challenge the financial stability of firms within this sector.

In particular, sports and recreation firms are grappling with the high costs of maintaining facilities and equipment, compounded by waning volunteer participation which adds to the financial burden. Smaller firms and not-for-profit organisations are especially vulnerable, struggling with limited financial reserves and constrained access to capital. These factors together heighten the risk of insolvency across the sector, placing these businesses in a precarious economic position.

Agriculture, forestry and fishing

Environmental and market forces are creating a precarious financial environment in the agriculture, forestry and fishing sector. Climate change’s disruptive impact, through extreme weather events like droughts, floods and bushfires, has severely hindered crop yields and affected livestock health. Volatile global commodity prices and trade uncertainty have intensified these challenges and undermined financial stability. Businesses in this sector also face escalating operational costs and labour shortages, all of which demand robust strategies to maintain profitability under continuously challenging conditions.

Healthcare and social assistance

Despite the number of insolvencies remaining relatively low, the number of businesses in the healthcare and social assistance sector that had an external administrator or controller appointed jumped 81.6% over the twelve months through October 2024. The sector has struggled with operational pressures, particularly severe staffing shortages and rigorous regulatory demands. Smaller providers face intense competition from larger firms that benefit from economies of scale, making it difficult to secure the funding necessary for compliance and technology investments. For this reason, maintaining financial viability poses a substantial challenge to businesses in this sector.

Construction

Notably, while the Construction division has not been among the sectors with the highest failure rates over the past year, it has experienced the greatest number of business insolvencies in 2024-25 so far, reflecting unique sectoral challenges. Interest rate fluctuations have significantly contributed to this rise in insolvencies. Higher rates lift borrowing costs, inflate project expenses and erode profit margins, particularly in fixed-price contracts. Increased mortgage rates have also weighed on consumer demand for new residential construction as potential buyers delay purchases, reducing the number of projects available and impacting builders' and contractors' revenue.

In response to expensive financing, companies often scale back on commercial construction investment, resulting in fewer projects and heightened competition among firms. These financial pressures create cashflow challenges, undermining construction firms' profitability. Many face insolvency with limited financial reserves amid high costs, with interest rate sensitivity remaining a critical factor in the ongoing insolvency trend.

Professional, scientific and technical services

Reduced client spending amid economic uncertainty has hit the professional, scientific and technical services sector hard, leading to a 69.5% hike in insolvencies over the year through October 2024. Cashflow issues in response to delayed payments compound the struggle to keep pace with rapid technological advancements like automation and artificial intelligence. Moreover, intense competition and globalisation pressures expose these firms to overseas competitors offering similar services at reduced rates, all of which threaten profitability and demand adaptability to ensure survival.

Across these sectors, a combination of economic pressures, regulatory challenges and evolving market dynamics underscore the need for businesses to implement strategic adaptations to effectively navigate the complexities of today’s economic landscape.

How can businesses mitigate the risk of failing?

- Strengthen financial management: This includes implementing detailed budgeting processes, maintaining emergency reserves and managing debt wisely to avoid over-leveraging. Diversifying funding sources, like exploring equity investments and alternative financing, lessens reliance on any single funding stream, boosting resilience against economic fluctuations.

- Look to diversify products, services and markets: By expanding product and service offerings and entering new markets to lessen dependency on a single revenue source, businesses can attract broader customer bases and mitigate risks associated with market volatility. Adapting to industry trends and evolving consumer preferences helps companies remain competitive.

- Foster strong relationships with stakeholders: Outstanding customer service and supplier collaboration reduce operational risks, while strategic alliances can open new markets. Investing in employee engagement through training and a supportive work environment enhances productivity and retention.

- Enhance risk management and contingency planning: Strong risk management frameworks help identify and mitigate potential threats. Regular risk assessments, prioritised mitigation efforts and contingency plans for critical risks prepare businesses for adverse events. Appropriate insurance coverage and staying informed about regulatory changes safeguard against losses and ensure compliance.

The ripple effects of business failures and B2B payment defaults on supply chains

The impacts of business failures and B2B payment defaults can extend far beyond the immediate parties involved, creating a series of financial challenges across the entire supply chain. It’s key for stakeholders to understand these interconnected dynamics as they navigate a volatile financial landscape and seek strategies to mitigate these widespread effects.

Banks and financial institutions

The wave of business failures and B2B payment defaults poses substantial challenges to banks and financial institutions. As more businesses falter, loan defaults surge, with sectors like food and beverage services experiencing higher rates of insolvency. This creates heightened credit risks, potentially requiring a reassessment of risk profiles and stricter lending practices. This reaction can make it more challenging for even financially stable businesses to secure the funding they need, slowing economic activity.

Compliance with regulatory capital adequacy requirements further lifts operational costs, impacting banks' performance and capacity to lend. Managing liquidity becomes increasingly complicated as reduced cash inflows from loan repayments intensify pressure to sustain financial stability. Banks with significant exposure to vulnerable sectors face heightened concentration risks, potentially curbing credit availability and threatening wider financial stability.

Suppliers and producers

Business defaults significantly impact suppliers and producers, which depend on timely payments to sustain cashflow and operations. When a client defaults, suppliers face immediate financial strain from delayed or unsettled invoices, which disrupts their financial liquidity. This instability can hinder their ability to settle obligations, like paying their own suppliers or covering operational expenses. The situation is particularly severe for suppliers heavily reliant on the defaulting business, as they may need to find new markets or cut back production, both of which can lift operational costs.

For example, in September 2024, Beston Global Food Company Ltd entered voluntary administration, impacting a broad range of suppliers. Dairy farmers, who were Beston's principal milk providers, are now confronted with considerable financial instability.

Distributors

Caught between suppliers and retailers, distributors face significant pressures as a result of defaults. Cashflow constraints arise when retailers default on payments, leading to difficulties in settling their own obligations to suppliers. This can trigger a domino effect of payment delays throughout the supply chain. The financial strain also complicates inventory management, as maintaining optimal stock levels becomes more difficult.

Faced with these challenged, distributors may need to reduce their inventories, leading to potential shortages and lost sales opportunities. To mitigate credit risks, distributors might tighten credit terms for retailers, which can strain business relationships and diminish sales volumes. Operationally, distributors potentially have to cut staff or scale back activities, hindering their ability to effectively serve downstream retailers.

In February 2023, Scott's Refrigerated Logistics collapsed, disrupting supply chains for the major supermarkets, affecting suppliers and the distribution of perishable goods nationwide. This left dairy producers and farmers struggling to get their products to market and stabilise their financial positions.

Retailers

The difficulties faced by suppliers and distributors often cascade down to retailers. When payment defaults and business failures cause financial instability for upstream firms, like distributors, retailers are often left grappling with delayed product deliveries and demands for upfront payments, putting strain on their financial resources.

These disruptions lead to inventory shortages, leaving retailers with empty shelves, lost sales and unsatisfied customers. To mitigate these shortages, retailers may need to turn to alternative suppliers, often incurring higher costs that erode their profit margins. Moreover, disrupted supply chains can force retailers to hold excess inventory of less popular items, driving up storage costs and necessitating markdowns.

For instance, during the pandemic, supply chain disruptions led to an oversupply of inventory at retailers like Myer and David Jones. To tackle this surplus and shift stock, they implemented aggressive discounting strategies.

Consumers

Disrupted supply chains can lead to product shortages and longer wait times for certain items, making it challenging for consumers to find what they need when they need it. As businesses navigate financial pressures, they might hike prices across various categories, further straining household budgets.

Economic instability, coupled with business failures, can erode consumer confidence, leading to more cautious spending habits. In response, consumers shift their shopping preferences towards discount retailers or online platforms, seeking better deals and more reliable suppliers.

How can firms manage the ripple effects of business failures and B2B payment defaults?

- Enhance credit risk assessments: Firms, including banks, suppliers and distributors, can enhance their ability to manage payment defaults by embracing advanced data analytics and predictive risk modelling. This approach allows them to scrutinise their clients’ creditworthiness more effectively, enabling timely interventions in case of anticipated payment defaults. Regular check-ins on clients’ and potential clients’ financial health also ensure that credit is extended cautiously, mitigating the likelihood of future defaults.

- Diversify client and supplier base: Engaging with a broad range of clients and suppliers reduces dependency on any one business. By distributing risk across several firms, companies can limit the effects of financial troubles in any single entity, maintaining a more stable cashflow. Extending this approach, banks can diversify their financial product offerings, which helps shield them from downturns in specific sectors.

- Negotiate secure contract terms: Incorporating stringent contractual safeguards like advance payments, performance bonds and letters of credit can secure financial transactions and safeguard businesses from potential defaults. By ensuring some payment upfront or guaranteeing funds through a bank, companies can reduce risks associated with delayed or missed payments.

- Maintain liquidity: Effective liquidity management is key to upholding business continuity. Facilitating access to flexible credit resources like revolving credit facilities or overdrafts can help businesses manage fluctuations smoothly. This strategic support assists in maintaining operational stability during downturns.

What’s next?

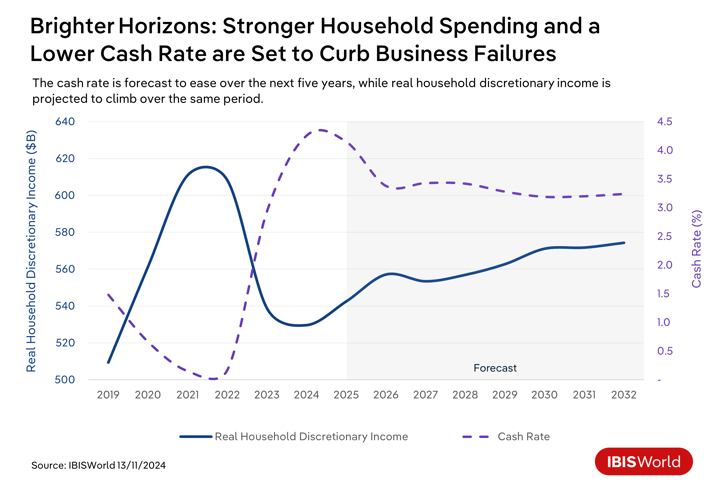

Looking ahead, Australia is set for economic shifts that could impact B2B payment defaults and business failures. As lingering inflationary pressures continue to ease over the short term, the Reserve Bank of Australia is anticipated to lower the cash rate in early 2025. Reduced borrowing costs will ease financial burdens on businesses with existing debts and encourage investment in growth initiatives. Improved access to affordable credit will enhance liquidity, allowing businesses to manage operational expenses and B2B payments more effectively. Even so, it will likely take several cash rate drops for businesses to feel the full effect.

Easing interest rates and reduced mortgage repayments over the next few years are poised to boost consumer confidence and spending on discretionary products and services. This trend will benefit businesses, enhancing their capacity to meet expenses and reducing payment defaults.

Despite a relatively positive outlook, several challenges remain. Global uncertainties like geopolitical tensions and trade disruptions have the potential to weigh on export-dependent industries, leading to potential payment defaults. The transition towards a low-carbon economy will continue to demand investment, affecting cashflows and possibly increasing B2B payment defaults if not implemented effectively. Moreover, the Australian Taxation Office's aggressive efforts to recover tax debts could add to pressure on cash-strapped businesses. Prioritising tax payments over supplier invoices might inadvertently contribute to a hike in B2B payment defaults.

What strategies can finance professionals adopt to enhance resilience and preparedness with emerging economic trends?

- Promote strategic financial planning: Encouraging businesses to engage in financial planning will help to successfully navigate evolving economic conditions. This includes regularly reviewing and adjusting financial strategies to reflect changes in interest rates, inflation and consumer spending patterns. By maintaining flexibility and adaptability in planning, firms can benefit from emerging opportunities and mitigate risks associated with economic shifts.

- Leverage technological innovation: Firms should prioritise adopting digital payment platforms and leveraging automation and blockchain technology. These tools can streamline financial transactions, enhance transparency and improve financial operations’ efficiency. This adoption facilitates faster, more secure transactions, reduces processing times and minimises errors.

- Improve risk management processes: To navigate potential economic uncertainty, professionals should enhance their risk management frameworks. This involves conducting regular stress testing and scenario analysis to understand the impact various economic conditions would have on financial stability. By identifying potential vulnerabilities and implementing effective mitigation strategies, firms can better withstand external shocks.

- Strengthen cashflow management: Efficient cashflow and working capital management are crucial to ensuring financial stability. Finance professionals should focus on optimising accounts receivable and payable processes to enhance liquidity. This can involve renegotiating payment terms with suppliers and customers, improving inventory management and employing dynamic cash forecasting techniques to ensure sufficient liquidity for operational needs and financial obligations.

Final Word

The uptick in business failures and B2B payment defaults in Australia underscores the need for companies to implement proactive and adaptable financial strategies. These challenges illustrate the crucial role that forward-thinking financial management plays in ensuring sustainability and resilience in a fluctuating economic landscape.

To effectively navigate these challenges, businesses must focus on maintaining ongoing vigilance and flexibility. This involves continuously monitoring economic trends and adjusting financial strategies in response to evolving market conditions. By doing so, businesses can better anticipate potential disruptions and adapt their operations to mitigate threats.

It’s crucial for companies to be adaptable in their financial planning and operations. This adaptability enables them to swiftly respond to immediate financial pressures and align their strategies with long-term economic shifts to remain competitive.