The Coal Mining industry has been an important contributor to the Australian economy over the past five years, generating approximately $275 billion in export revenue over the period. Coal is expected to remain Australia’s second largest resource export by value in 2021-22, with Australia retaining its position as the world’s largest exporter of metallurgical coal and second largest exporter of thermal coal. Metallurgical coal is used to produce coke, which is used by steel makers, while thermal coal is used to generate energy in coal-fired power stations.

Global demand conditions

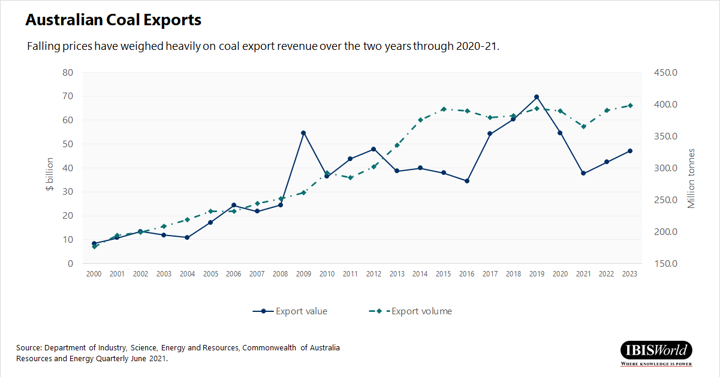

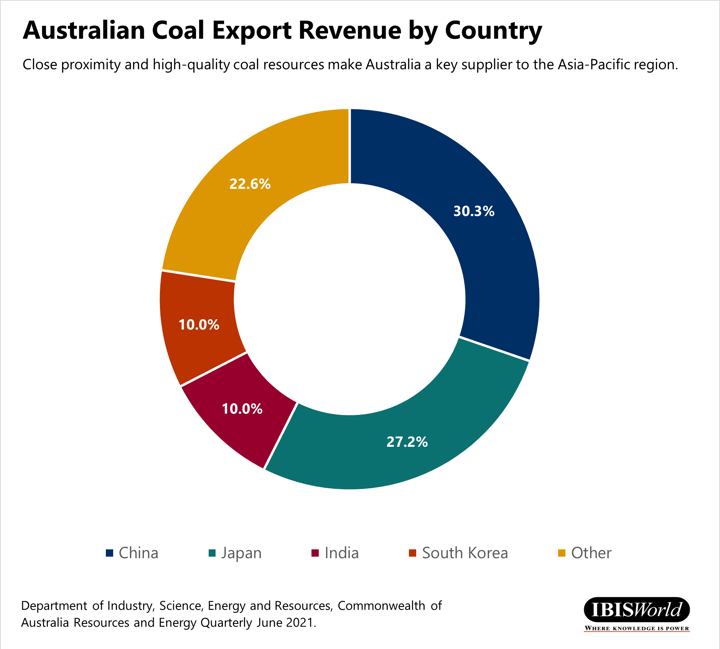

Coal exports fell sharply over the two years through 2020-21, as the fallout from the COVID-19 pandemic weakened global demand. Trade tensions between Australia and China also threatened coal exports, with China placing unofficial restrictions on imports of Australian coal in late 2020. These restrictions created additional headwinds for Australian coal producers. Coal export prices declined by 20.9% in 2019-20 and fell a further 22.6% in 2020-21. Low prices pushed companies to place some mines into care and maintenance, while the value of Australia’s coal exports fell by over 30% in 2020-21.

While global prices were extremely volatile throughout the COVID-19 pandemic, global efforts to kickstart economic activity have since placed upward pressure on coal demand. Recovering global electricity demand caused thermal coal prices to soar in early 2021-22, with high prices anticipated to support export revenue for coal miners over the year. Australia’s Coal Mining industry is heavily dependent on export markets, with exports expected to account for over 85% of Australian coal mining revenue in 2021-22.

- Metallurgical coal exports are expected to rise by 7.0% in 2021-22 to 183.7 million tonnes

- Thermal coal exports are expected to rise by 7.3% in 2021-22 to 208.2 million tonnes

ESG headwinds

Coal power still accounts for over a quarter of global electricity generation and over half of Australia’s electricity generation. While thermal coal’s place in the global energy mix is projected to come under increasing pressure over the next decade, Australian coal production is forecast to grow in the short term. Despite rising concern over environmental issues and commitments from governments around to globe to introduce net zero targets, global coal consumption is also projected to remain strong over the next five years. As a result, the Australian Coal Mining industry’s revenue is expected to grow at an annualised 3.1% over the five years through 2026-27.

In late 2020, Australia’s two largest export markets for coal, Japan and China, announced plans to achieve net zero carbon emissions by 2050 and 2060 respectively. Despite coal power generation declining in many parts of the world, demand for thermal coal is expected to remain robust in the short term. According to the Global Energy Monitor, China has 96.7 gigawatts of coal-fired power generation under construction, with a further 163.3 gigawatts in various stages of planning, while India has 34.4 gigawatts under construction.

Outlook

Despite robust demand in the short term, pressure is mounting on coal miners, making the long-term outlook more uncertain. Major financial institutions and insurers are reducing exposure to the industry. Some institutional investors have also made moves to divest from fossil fuel related businesses. These factors are making it difficult for coal miners to develop new mines or expand existing projects, which is forecast to limit industry output over the long term. Despite the shifting focus towards renewable energy sources, coal is forecast to remain a key part of the global energy mix and continue to be an important contributor to the Australian economy for years to come.

IBISWorld industry reports used to develop this release:

- Coal Mining in Australia