Key Takeaways

- Emerging technologies like 3D printing, artificial intelligence, and fintech are driving significant global industry growth by reshaping consumer access, transaction methods and business operations.

- Strategic research into high-growth industries enables businesses to capitalize on rapid advancements by understanding market dynamics, identifying opportunities and refining competitive strategies.

- Collaboration, innovation, and adaptability are critical for companies seeking to thrive in industries transformed by new technologies, enabling them to stay ahead of evolving consumer needs and global trends.

2024 marked a period of historic growth for many industries across the global economy. As we look forward to 2025, several global industries are primed for significant expansion, driven by rapid technological advancements and evolving consumer behaviors.

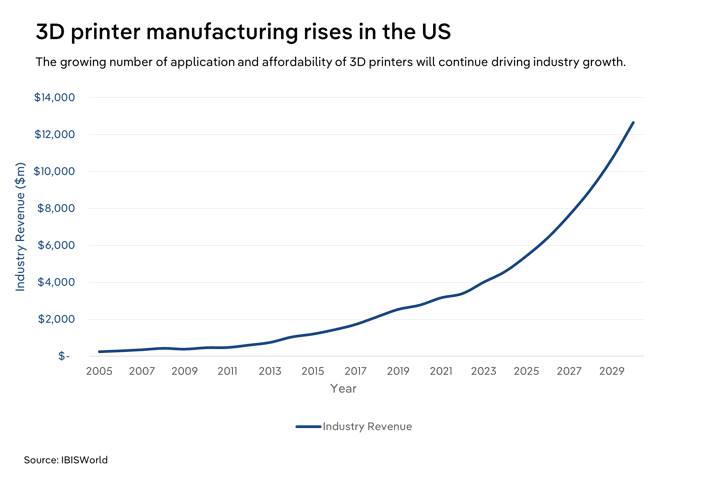

Specifically, new technologies are fundamentally reshaping consumer access to information and goods, as well as payment methods for services. Industries like 3D printing, artificial intelligence and fintech are experiencing double-digit growth, reflecting abundant global business opportunities.

To qualify an industry as high-growth, we consider indicators such as revenue growth rates, technological innovation, market expansion potential and transformative impact on consumer access and transaction methods. These indicators provide a comprehensive view of an industry's trajectory and its capacity to redefine markets.

However, to effectively capitalize on high-growth industries, businesses must engage in thorough industry-level research. This research helps in understanding the nuances and dynamics of high-growth sectors, enabling businesses and consumers alike to make informed decisions and seize the resulting opportunities across the globe.

3D printing in the US

Traditionally, the production of most physical goods has relied on injection molding, a process known for its significant capital investment and high-volume output. However, recent advancements in manufacturing technology have led to the adoption of new production methods. One major development is the rise of additive manufacturing, also known as 3D printing. This shift, fueled by technological progress and the expiration of key patents, has profoundly influenced product development cycles and increased consumer access to niche, customized products.

While injection molding necessitates costly molds for each product, making new product launches expensive and risky, 3D printing offers a cost-effective alternative for prototyping and iteration. Instead of investing thousands of dollars in prototyping via injection molding, businesses can spend less than a dollar to create a new model and receive immediate feedback from a customer. This method facilitates validated learning by enabling rapid experimentation and iteration, allowing businesses to quickly adjust their products based on real-world customer feedback.

3D printers are increasingly being utilized in the medical, aerospace and automotive sectors. In the medical field, they are used to produce implants, prosthetics, dental applications and even bioprinted tissues. For instance, Stryker Corporation employs additive manufacturing to create the Triathlon Titanium joint replacement component, which can only be made using this technology. In auto manufacturing, additive manufacturing is often used to produce molds, aftermarket parts, and spare engine components. For example, General Motors' 2024 Cadillac Celestiq features more than 100 3D-printed components, including window switches, grab handles, decorative parts and seatbelt D-rings. In the aerospace industry, 3D printing is primarily utilized to produce lightweight components through topology optimization. Boeing, for example, uses 3D printing to reduce the weight of engine components for its satellites by applying material only where necessary, and it streamlines production processes by printing airplane components as a single piece rather than assembling multiple parts.

3D printers are also becoming increasingly popular among regular consumers, who primarily use them as a hobby, though their applications are constantly expanding. The widespread adoption of consumer-grade 3D printers has been driven by decreasing technology costs, fueled by growing competition and patent expirations, as well as an expanding collection of publicly accessible 3D models. BambuLab, a relatively new player in the 3D printing industry, has significantly intensified competition in the consumer market. By offering advanced features such as high-speed capabilities, multi-material printing and remote control while maintaining affordability, the company has set a new standard for desktop 3D printers. Additionally, the growing availability of 3D assets on websites like Thingiverse, CGTrader and Sketchfab has further heightened consumer interest in the technology.

While growth in the 3D printing industry is driven primarily by private investments, the industry also receives support from public initiatives and industry associations. For example, America Makes works to accelerate the adoption of additive manufacturing and the US global manufacturing competitiveness through education, research and networking. While broader in its nature, the Australian Manufacturing Forum promotes the adoption of innovative manufacturing techniques, like additive manufacturing, in Australia. In the UK, Additive Manufacturing UK supports the industry by fostering collaboration, knowledge sharing and advancement within the industry.

Additive manufacturing presents various business opportunities, depending on the services offered. For instance, while companies like 3D Systems and Stratasys have established operations the 3D printer manufacturing industry, the industry remains highly fragmented, allowing new, innovative firms to enter the market more easily. To enter the industry, 3D printer manufacturers often focus on features such as printing speed, size, accuracy and user experience. Another opportunity lies in developing new materials for 3D printers. Although PLA and ABS are the most prevalent materials, especially in the consumer market, the increasing availability of metal alloys and conductive materials is expanding the range of 3D printing applications. Additionally, despite the growing adoption of 3D printers by consumers and businesses, there remains a substantial market for outsourced 3D printing services, like those offered by Stratasys Direct and Shapeways. Offering services that support a variety of materials and 3D printing technologies—such as SLA, SLS and MJF—can help new entrants differentiate their offerings and capture a share of this market.

Key success factors:

- Rapid prototyping and iteration: Companies should leverage 3D printing's cost-effective prototyping capabilities, allowing for quick experimentation and real-time feedback integration to refine products and reduce time-to-market.

- Materials and applications: Expanding the range of materials available for 3D printing, such as incorporating metal alloys and conductive materials, will enable companies to broaden application areas across industries like medical, aerospace, and automotive, fostering growth.

- Consumer engagement and access: With increasing consumer interest, facilitating access to user-friendly, affordable 3D printers and a vast library of 3D models can help capture a larger consumer base and drive mass adoption.

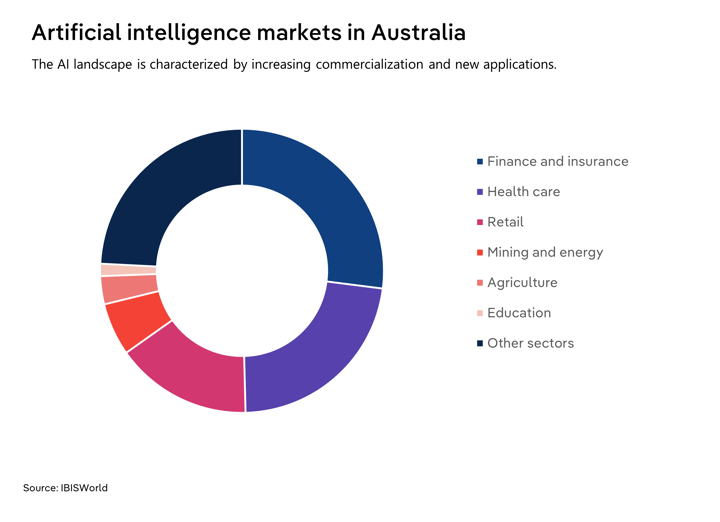

Artificial intelligence in Australia

The artificial intelligence (AI) landscape in Australia is experiencing robust growth, characterized by increasing commercialization and expanding applications across various sectors. The foundation for this growth was laid by a surge of new entrants in the 2010s, driven by enhanced investment and research efforts. Today, many AI companies in Australia are transitioning from development phases to commercial viability, positioning themselves to achieve profitability and contribute significantly to economic expansion.

AI's advancing functionality has generated substantial interest, particularly in sectors such as healthcare and agriculture. In healthcare, collaborations like those between harrison.ai and I-MED Radiology highlight AI's transformative impact on diagnostics, utilizing new tools for more accurate X-ray analysis. The agricultural sector is also increasingly leveraging AI to modernize traditional practices, employing technologies for crop monitoring and predictive analytics that boost sustainability and operational efficiency.

Although ChatGPT, developed by the US-based company OpenAI, drove global interest in AI, its public release in 2022 had ripple effects felt in Australia as well. The widespread adoption of generative AI technologies following ChatGPT's introduction has expanded the potential user base in Australia. This has accelerated the curiosity and integration of AI across various industries, benefiting small and medium enterprises and bringing AI solutions into greater everyday use.

Australia's AI industry also benefits from a dynamic startup ecosystem and significant international investment. With the majority of venture capital for Australian AI companies coming from global investors, particularly from the US, Singapore and the UK, the industry enjoys international confidence and financial backing. This influx of capital underscores the growth potential of the Australian AI industry and supports its companies in scaling innovations to compete globally.

The release of transformative AI technologies has encouraged companies to explore new business models and product offerings, reflecting the industry's adaptability and resilience. While ChatGPT itself may not be Australian, the interest it sparked has galvanized local firms to develop complementary AI solutions, demonstrating the innovative spirit within Australia's AI ecosystem.

Alongside foreign investments, the industry is being supported by government initiatives. For example, the Australian government announced in December 2024 its intentions to boost domestic investments in national AI capabilities through the National AI Capability Plan. This plan focuses on encouraging private investments in AI, fostering AI research at educational institutions, providing tools to enhance AI training and developing essential infrastructure. Similarly, the UK government had provided industry support through education initiatives, such as providing £17 million to boost skills and diversity in AI jobs. Meanwhile, the US government has initiated The Global AI Research Agenda to advance safe, secure and trustworthy development of AI systems.

The Australian AI industry is on a promising growth trajectory, fueled by advancements in technology, international and government support. As companies continue to leverage AI's transformative potential, the industry is poised to enhance productivity and drive innovation across the Australian economy, with a potential impact of $600 billion a year towards Australia’s GDP by 2030. With an openness to integrate new technologies and evolve existing practices, Australia is well-positioned to capitalize on AI opportunities, strengthening its status as a leader in technological advancement and economic development.

Key success factors:

- Collaboration and partnerships: Successful navigation of high growth in the Australian AI sector will be contingent upon forming strategic collaborations to combine expertise and accelerate technological adoption across industries.

- Robust international investment: Leveraging international venture capital, particularly from investors in the US, Singapore and the UK, is crucial as it provides the financial backing needed for scaling innovations and competing on a global stage, reflecting international confidence in Australian AI companies.

- Innovation and adaptability: The ability of Australian AI companies to swiftly develop complementary AI solutions and explore new business models in response to global trends, such as those introduced by ChatGPT, will be essential for maintaining competitive advantage and driving industry expansion.

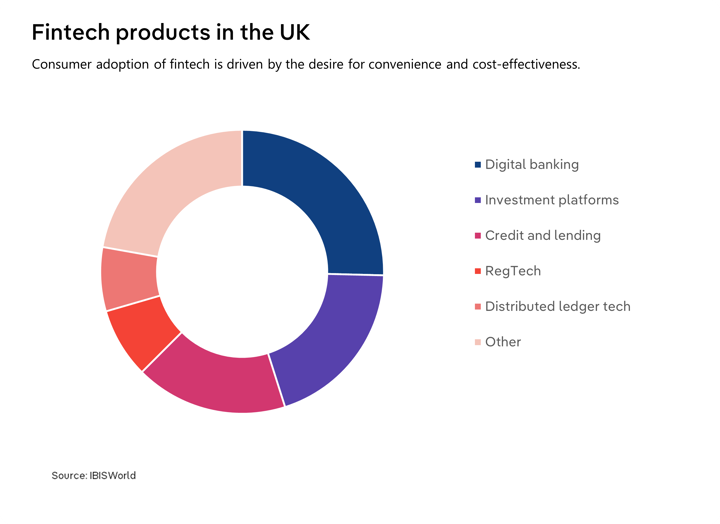

Fintech in the UK

The UK's financial technology (fintech) industry is renowned for its vibrant innovation and significant contribution to both the national and global economy. With London serving as the second-largest global financial hub, the UK offers a fertile environment for fintech companies, bolstered by supportive government policies, a rich talent pool and a keen adoption of digital solutions within financial services.

The UK government has been instrumental in nurturing the fintech industry through initiatives that ease regulatory navigation and foster innovation. Notably, the Financial Conduct Authority’s (FCA) regulatory sandbox allows firms to test new ideas with consumers while under regulatory supervision. This has been beneficial for companies like Zopa, one of the pioneers in peer-to-peer lending, which utilized the sandbox to refine its offerings. Furthermore, the introduction of the UK Fintech Strategy has outlined pathways to enhance the industry, including promoting financial inclusion and supporting digital finance growth. The Kalifa Review of UK Fintech, released in 2021, further provided a blueprint for maintaining the UK's competitive edge. Although comparable programs exist in other countries, including state-wide regulatory sandboxes in the US and a regulatory framework by the Australian Securities and Investments Commission, the UK's FCA regulatory sandbox is more established and widely recognized for fostering fintech innovation.

The UK has seen significant fintech innovation, revolutionizing traditional services across payments, lending, insurance and wealth management. Revolut, for example, has transformed payments by providing a platform that allows users to hold and exchange multiple currencies at interbank exchange rates, eliminating the hidden fees typically associated with international transactions. Similarly, Wise (formerly TransferWise) has offered a disruptive model in cross-border payments with its peer-to-peer system, which reduces costs and speeds up transfer times. In lending, Funding Circle leverages technology to connect small businesses directly with investors, offering competitive rates and quicker loan approvals compared to traditional banks.

Consumer adoption of fintech in the UK is robust, driven by the desire for convenience and cost-effectiveness. Mobile banking solutions, like those provided by Starling Bank and Monzo, have seen a rapid increase in user numbers. These challenger banks offer seamless, app-based banking experiences that place user-centric design at the forefront. The Open Banking initiative in the UK has also been a game changer, requiring traditional banks to share data with registered third-party providers upon customer consent. This has paved the way for aggregators like Money Dashboard, which use open APIs to provide users with comprehensive financial overviews, thus helping them make better financial decisions.

The UK hosts a thriving fintech ecosystem, supported by an active network of startups and accelerators. In addition to London, cities such as Edinburgh with companies like Money Dashboard, and Manchester with access to tech talent and investments, are becoming key innovation hubs. The investment climate remains strong; in 2024, the UK's fintech sector attracted billions in venture capital, with notable investments like a $430 million funding round for Monzo, one of the earliest app-based challenger banks in the UK.

Despite the strengths, the UK’s fintech industry faces challenges, including navigating post-Brexit regulatory changes and addressing cybersecurity threats. Each challenge, however, offers a corresponding opportunity. For example, as digital threats evolve, there is potential for growth in cybersecurity solutions tailored for fintech. Additionally, focusing on financial inclusion—developing solutions for the underbanked—presents a vast market opportunity. Blockchain technology continues to hold potential for creating more transparent financial ecosystems, with companies like Blockchain.com leading advancements in secure digital transactions.

In conclusion, the UK’s fintech industry is on a promising growth trajectory fueled by innovation, strong government backing, and a vibrant startup ecosystem. Through technological advancements and strategic responses to current challenges, the UK is well-positioned to maintain its leadership in global Fintech, driving forward economic development in the digital finance era.

Key success factors:

- Regulatory support and innovation facilitation: Leveraging government initiatives, like the FCA's regulatory sandbox, enables fintech companies to experiment and innovate under regulatory supervision, reducing risks and refining offerings before a full-scale launch.

- Consumer-centric digital solutions: Developing user-friendly, app-based banking solutions and capitalizing on trends such as Open Banking ensures high consumer adoption rates by offering convenience, transparency, and cost-effectiveness.

- Focus on financial inclusion and cybersecurity: Addressing the needs of the underbanked and developing specialized cybersecurity solutions present opportunities for expansion, ensuring resilience and access to untapped markets amid evolving digital threats.

Final Word

The global landscape of high-growth industries, such as 3D printing, artificial intelligence and fintech, is marked by rapid advancements and abundant opportunities. To effectively seize opportunities in these fast-evolving industries, companies must engage in comprehensive industry-level analysis, benchmarking and research. Understanding market dynamics, technological advancements, and consumer trends allows businesses to identify niche markets and innovate accordingly. Benchmarking against industry leaders can unveil best practices, highlight competitive differentiators and guide strategic adjustments.

Investing in research and development fosters innovation, enabling companies to remain agile and responsive to emerging trends. By staying informed on regulatory changes, global economic shifts and technological disruptions, businesses can better anticipate challenges and enact proactive strategies. Additionally, cultivating partnerships and collaborations can enhance capabilities and market reach.

Overall, embracing strategic foresight through diligent analysis and research equips companies to navigate high-growth industries effectively, ensuring long-term success and sustainability in an ever-evolving global market.