Key Takeaways

- Greenwashing is becoming more prevalent in the finance sector due to increased investor focus on sustainability, leading to tightened regulations.

- Multiple financial institutions have faced substantial fines for greenwashing activities, highlighting the associated long-term risks and reputational damage.

- Regulatory bodies have introduced legislation to target greenwashing, demanding financial institutions ensure transparency and truthfulness in sustainability disclosures and environmental claims.

The rise of greenwashing in finance

Investors are becoming increasingly aware of their portfolios' environmental impacts, preferring to invest in companies that successfully manage their ESG risks and opportunities. Financial market players' growing focus on environmental initiatives and sustainable investing is increasing the burden on executives, with over 90% feeling pressure to focus on ESG initiatives.

Some companies respond to these pressures by greenwashing: making false impressions or misleading claims about how their products and policies are environmentally responsible.

A firm may greenwash by claiming to invest in clean energy projects to attract environmentally conscious investors while most of its portfolio comprises companies that are heavy fossil fuel users or associated with deforestation, thereby misleading investors.

Similarly, another firm may promote false carbon neutrality, purchasing carbon offsets instead of actually reducing its carbon emissions. These token efforts distract from its broader environmental impact, leaving investors with a skewed view of the firm's priorities.

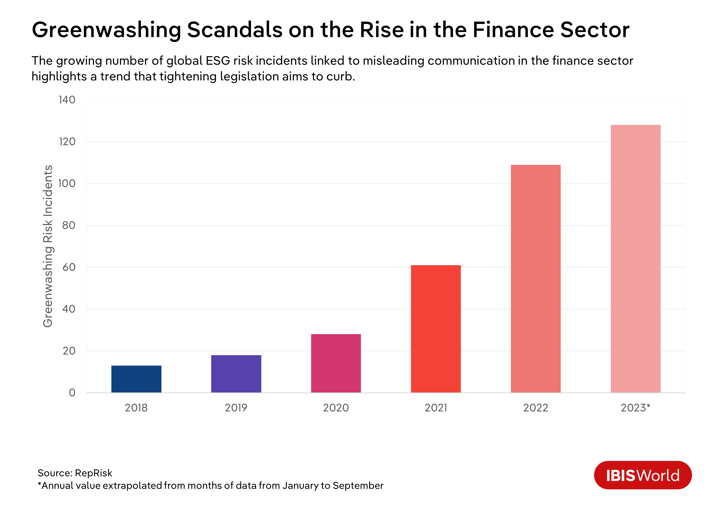

The long-term consequences of greenwashing, like reputational damage and regulatory penalties, can severely affect business growth and investor confidence. With greenwashing incidents in the banking and finance sector rising by 70% globally in the 12 months through September 2023, the pressure to ensure genuine and transparent sustainability efforts is higher than ever.

The risk of greenwashing

While greenwashing can provide a short-term solution to external noise and internal pressures, the long-term risks are substantial. Market regulators are introducing increasing regulatory requirements to quell financial institutions' ability to greenwash in their business strategies and product statements.

Identifying and eradicating greenwashing in company statements will be increasingly vital to business success. Not only will it be imperative to reduce regulatory risk, but it will also protect company reputations that would be threatened by prosecution.

Key examples and consequences

The consequences of greenwashing are growing and far reaching. In recent years, several high-profile financial institutions have faced fines and regulatory scrutiny for making misleading environmental claims. Some key examples include:

- November 2022: Goldman Sachs Asset Management was fined US$4.0 million by the Securities and Exchange Commission (SEC) for policy failures related to three of its ESG-marketed investments.

- September 2023: DWS Investment Management Americas was fined US$19.0 million by the SEC for misstatements surrounding its ESG investment process.

- August 2024: Mercer Superannuation (Australia) was fined AU$11.3 million by the Federal Court of Australia for making misleading climate statements regarding seven of its ‘Sustainable Plus’ superannuation investment options.

The long-term risks

Financial sanctions for greenwashing may seem manageable initially, but the long-term damage to investor trust and confidence can be severe.

As legislative power grows, those who prioritize short-term profits over long-term sustainability by making investments that don’t comply with their environmental claims face larger financial sanctions and fines. With rising public awareness, financial institutions embroiled in greenwashing scandals will suffer severe reputational damage. Customers will lose trust and take their business elsewhere, causing substantial financial losses.

Tackling greenwashing globally

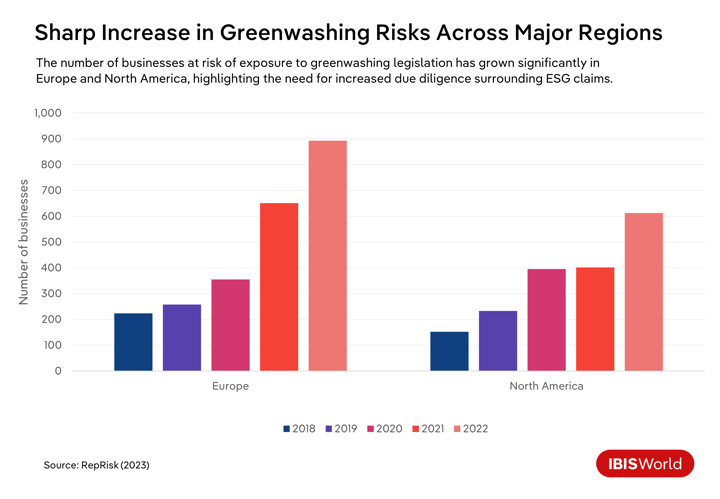

Greenwashing has historically been hard to police due to a lack of stringent and targeted regulations. However, financial regulators globally have begun introducing legislation to address this issue.

Australia’s regulatory response

The Australian Consumer Law (ACL) restricts greenwashing by prohibiting false or misleading representations and deceptive conduct. The Australian Competition and Consumer Commission (ACCC) can prosecute companies that breach the ACL, pressuring businesses to ensure their environmental claims are truthful and verifiable.

The United Kingdom’s approach

The Financial Conduct Authority (FCA) is targeting greenwashing in the UK with the Sustainability Disclosure Requirements (SDR) regime, effective since November 2023. This ensures that sustainability-related claims are clear, fair and not misleading. From December 2024, restrictions on environmental terminology in product names will come into force, similar to the SEC’s ‘Names Rule’ in the United States.

The United States and the SEC’s enhanced disclosures

The United States is also stepping up its efforts to combat greenwashing. The SEC is set to enhance its control over greenwashing with the Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices rule. The policy, effective since October 2024, mandates financial institutions to provide additional information regarding their ESG investment practices, creating a consistent regulatory framework to keep investors informed.

The European Union’s efforts

The European Union’s Sustainable Finance Disclosure Regulation (SFDR), effective since March 2021, boosts ESG transparency requirements in finance. Since January 2024, the Corporate Sustainability Reporting Directive (CSRD) has mandated climate impact reporting from around 50,000 entities. Additionally, the proposed Green Claims Directive aims to ensure that environmental claims are strongly evidence based.

The regulatory impact

Tighter greenwashing regulations will push financial institutions to ensure greater transparency about their products and services’ environmental impact. Clear, truthful disclosures will reduce regulatory risks and protect reputations.

Stringent regulations will affect executive-level decisions on fund portfolio breakdowns. Executives will have to align investment strategies with their sustainability claims and advertised product names.

Strategies for success

Understand the importance of employee education and training

Financial institutions should invest in training to help employees comply with increasing regulations. Comprehensive training programs can educate employees on legal requirements, the implications of misleading claims and the importance of authenticity in environmental initiatives.

Enhancing company-wide understanding improves decision-making and communication with consumers, promoting transparency and reducing greenwashing risks.

Invest resources into regulatory compliance

To minimize risk, investing in regulatory compliance is imperative. Executives can follow two strategies: human or financial investment.

- Human investment involves creating a dedicated team with expertise in emerging governmental policy, ensuring the company stays ahead of any regulatory changes and preventing potential breaches. This also ensures the company’s regulatory compliance framework remains vertically integrated, providing employees with control and company-specific knowledge.

- Given the complexity of environmental laws and regulations, financial investment may be a more suitable approach. Financial firms could outsource greenwashing compliance tasks to a legal consulting firm rather than establishing a permanent in-house team. Engaging an external perspective can provide valuable insights and guidance while minimizing risks associated with non-compliance. This frees up valuable time and maximizes efficiency.

Report proactively

Rather than simply responding to regulatory changes, companies should proactively report on sustainability efforts. Staying ahead of regulations demonstrates a commitment to making a positive environmental impact while mitigating the risk of regulatory penalties and reputational damage. Moreover, providing transparent communication about progress and setbacks boosts a company’s reputation, helping build trust with investors and stakeholders.

How to identify greenwashing in finance

Greenwashing can be challenging to identify, particularly from an external perspective. However, financial institutions must be vigilant in scrutinizing their own operations and the broader industry for misleading or exaggerated environmental claims. Several resources and guidelines are available to help institutions in this effort.

Key resources to detect greenwashing

In the United Kingdom, the Competition and Markets Authority has published the Green Claims Code, which provides clear guidance for identifying false or misleading environmental claims. In Australia, financial institutions can refer to ASIC’s Information Sheet 271 or consult guidance from the ACCC on proper environmental marketing practices.

Common greenwashing red flags

Executives should be aware of the most common indicators of greenwashing in financial products and ESG claims. Key red flags include:

Vague and jargon-heavy terminology: Environmental claims should be clear and easily understandable. Unclear terminology can confuse investors and can be a warning sign for greenwashing. Any non-standard terminology should be clearly explained in the product disclosure statement (PDS).

Exaggeration of environmental impacts: Overstating the positive effect of a project or investment can be just as problematic as making false claims. Financial institutions must ensure that their environmental statements are accurate and supported by evidence.

Lack of verification: Environmental claims that are not supported by certified external verification or solid internal data may indicate greenwashing. Institutions should rely on third-party audits or verifiable data to substantiate their claims.

Strategies for success

Focus on metrics-based reporting

Effective data collection and evaluation strategies can simplify internal checks to tackle greenwashing. Financial institutions that report on sustainability metrics using clear and consistent methodologies allow scrutiny from all stakeholders, which minimizes greenwashing risks.

Regularly updating key metrics allows companies to compare their progress against industry benchmarks, improving the transparency of their environmental impact and reducing the likelihood of greenwashing.

Install a rigid editorial process

A rigorous editorial process can prevent greenwashing and enhance transparency. Carefully reviewing and validating all environmental claims made in company communications, from product descriptions to public ESG statements, can minimize the risk of greenwashing.

Marketing and communications staff should receive clear guidelines on the wording and presentation of environmental claims to avoid exaggeration or ambiguity. A specialized editorial team can then verify these claims against current regulatory standards to ensure they meet best practices. All public content should be fact checked and proofread multiple times before release to ensure accuracy and honesty.

Ensure transparency in communication channels

Clear and honest communication about a company's sustainability efforts and challenges goes beyond avoiding major greenwashing red flags like ambiguity and exaggeration. It also involves providing clients and investors with comprehensive context and information about how the company is capitalizing on transition opportunities. Regular detailed briefings to investors on sustainability progress and setbacks can increase trust and transparency, limiting the possibility of greenwashing.

Clients and investors value a true understanding of a company's ESG performance, including both successes and areas for improvement, which allows them to make informed investment decisions. A fully transparent approach reassures clients and investors of a company's integrity and strengthens the company's reputation.

Strengthening ESG due diligence and building credible portfolios

As regulatory scrutiny increases, building credible ESG portfolios is more crucial than ever. Financial institutions need to ensure that their ESG claims and portfolios are supported by data and accurately reflect their advertised names to avoid scrutiny from market regulators and external shareholders.

Building credibility through enhanced due diligence processes will minimize the threat of financial penalties and boost investor confidence by ensuring that claims about environmental projects or ESG initiatives are accurate.

Executives must provide guidance to ensure ESG claims are genuine, backed by data and verifiable, particularly in the event of an audit. To promote transparency, ESG statements should be made public, allowing external stakeholders to scrutinize claims.

When it comes to ESG portfolios and environmentally marketed funds, executives must ensure financial investments are thoroughly scrutinized to mitigate legal risk. Conducting a rigorous review process for new investments can reduce the risk of greenwashing by association.

Strategies for success

Employ a Chief Sustainability Officer

Financial businesses can appoint a Chief Sustainability Officer (CSO) to make sincere commitments to sustainability and streamline efforts to minimize greenwashing. Demand for these positions has increased over the past decade and will continue rising as investor focus on green initiatives swells.

To gain a competitive edge, financial firms should prioritize hiring a CSO, as this provides a strong public signal of the company’s sustainability intent. CSOs can improve due diligence processes and require approval from senior executives for all public environmental claims. CSOs can also create and implement a standardized framework for environmentally marketed products that defines key metrics and evaluation techniques, ensuring that all aspects of ESG compliance are considered.

Integrate green lending opportunities

Integrating green lending opportunities strategically reduces greenwashing and enhances ESG due diligence. By investing in environmentally impactful projects, financial institutions validate their commitment to sustainability, mitigating greenwashing risks through tangible action. This helps strengthen their environmental portfolio and demonstrates their role in advancing sustainable practices.

Focusing on green lending allows financial institutions to identify untapped markets as public demand for green products, services and projects grows. Financial institutions in tune with this growing market can provide value to shareholders and stimulate demand from prospective investors.

Involve third-party audits

Third-party audits enhance ESG due diligence by verifying the accuracy and credibility of ESG claims through an unbiased lens. External auditors can identify potential risks and non-compliance that may have been overlooked internally by bringing a fresh perspective and extensive knowledge of ESG regulatory developments and best practices. Pinpointing these issues early means organizations can proactively solve issues and minimize the risk of reputational damage.

Third-party audits offer peace of mind during regulatory investigations, as the company can be safe in the knowledge that decisions and statements have already undergone rigorous examination. This can also boost investor confidence by demonstrating a commitment to transparency and accountability.

Final Word

As the regulatory landscape continues evolving, greenwashing prosecutions will likely rise globally. Executives must revisit and re-evaluate their company’s risk management strategies to reduce the threat of litigation affecting company performance.

Financial institutions that strengthen their ESG due diligence processes and align their portfolios with genuine environmental commitments will not only mitigate risks but also capitalize on growing demand for sustainable investments. By doing so, they will be well-positioned for long-term success, driven by business growth and enhanced client retention.