Key Takeaways

- Reveal hidden risks early by using industry-level risk ratings to catch structural or cyclical vulnerabilities before financials deteriorate.

- Continuously monitor portfolio exposure with risk trend data to support faster pivots and proactive credit management.

- Explain risk decisions clearly using consistent, third-party ratings to align teams and speed up approvals.

- Embed risk ratings into workflows to reduce low-quality submissions and help frontline teams act on risk insight sooner.

Underwriters, you’ve seen it before: a borrower’s financials look strong, the narrative sounds compelling, and the loan package passes initial scrutiny. But months later, things unravel—not because the borrower misled you, but because their industry took a sudden hit.

Sometimes, even the most diligent financial analysis can’t uncover the full picture. That’s because many risks often live outside the borrower’s balance sheet: in the market dynamics, supply chains, labor conditions and regulations that define their industry.

When you get a product price wrong, you fix it the next day. But when you misjudge a credit decision, the consequences can last six years or more. With time pressure mounting, and internal stakeholders relying on your assessment, there’s no room for gut feeling alone. You need credible, industry-specific insight to back your judgement and spot red flags early.

From structural weaknesses and macroeconomic volatility to shrinking margins and unexpected policy shifts, a borrower’s viability is often at the mercy of their industry. Consider Blockbuster. At its peak, it was an American institution. But despite its dominance, it was structurally exposed to the streaming revolution. Today, Netflix is a unicorn and Blockbuster is a trivia answer.

Or take the story from one of our Canadian banks about a manufacturing firm (profitable and well-run) until new tariffs disrupted its U.S. supply chain. Scrambling to retool their procurement through Turkey and Germany, their client had to pause operations and lay off staff, eroding financial stability almost overnight.

As credit professionals, you can’t control these forces, but you can anticipate them. That’s where IBISWorld’s Industry Risk Ratings and Early Warning System come in, offering third-party indicators to complement your internal Key Risk Indicators (KRIs).

With tools built to flag industry-level vulnerability, you can focus attention where it’s needed, support decisions with data and protect your portfolio before financials falter.

Understanding the three types of risk

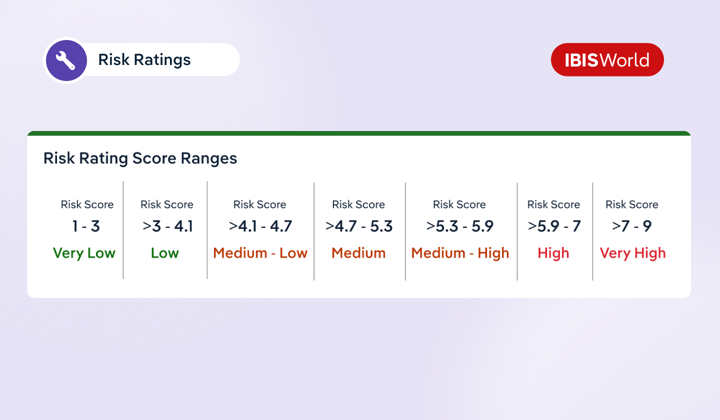

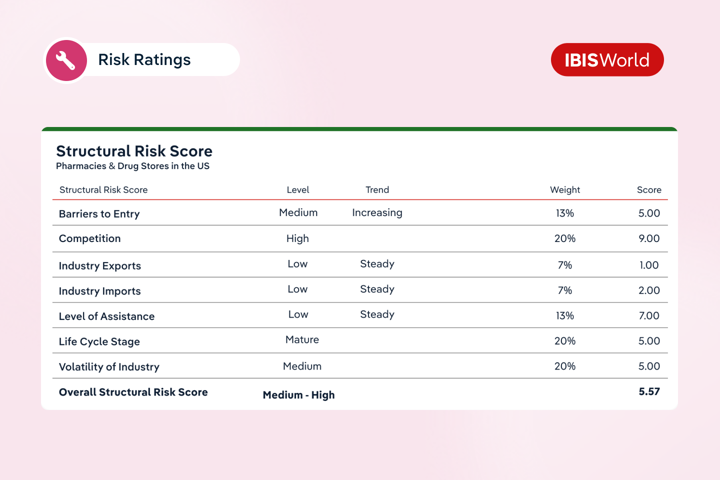

IBISWorld’s Industry Risk Ratings assess risk across three critical dimensions: Structural, Growth, and Sensitivity. Each one brings unique insight, and together, they form a complete view of industry-level risk, helping you flag threats early, triage borrower files faster and make decisions with confidence.

Structural risk

This score reflects the competitive dynamics of the industry: concentration, fragmentation, regulation and barriers to entry. Is the market crowded with undifferentiated players? Are margins razor-thin due to intense price competition? Is the industry heavily regulated, increasing compliance costs?

Think of retail pharmacies or independent truckers—industries with high Structural Risk due to commoditization and limited pricing power. For credit professionals, this can show up as shrinking margins that don’t yet appear in the borrower’s financials, but signal limited room to absorb shocks.

Growth risk

This dimension captures long-term industry outlook, investment potential, and demand trajectory. Is the industry expanding, flatlining, or shrinking? Are there technology shifts or demographic changes that could drive or deter growth?

For example, coal mining may show acceptable short-term returns but scores high on Growth Risk due to environmental shifts and energy transition. This lens helps credit teams avoid over-relying on past performance, and prompts more cautious structuring when long-term demand is under threat.

Sensitivity risk

This score reflects an industry’s exposure to macroeconomic variables like interest rates, fuel prices, labor costs, or policy shocks. Industries like hospitality and construction often carry higher Sensitivity Risk due to economic cyclicality or regulation.

Take the example of a solid-looking furniture company during COVID. Their numbers seemed fine until massive shipping delays turned a year-long wait for a couch into a cash flow crisis. The issue wasn’t internal mismanagement. It was their high Sensitivity Risk from global supply chain fragility. When you’re reviewing borrowers in volatile sectors, this lens helps you identify where otherwise strong files may need added pricing provisions or closer scrutiny.

Revealing hidden risk before it hits the financials

You know what it’s like to be blindsided—when something that looked fine on paper crumbles under pressure. That’s why leading banks now incorporate IBISWorld’s risk ratings into their risk methodologies and dashboards to avoid false positives during credit reviews.

Often banks come to us after they realize a gap exists: their models include internal borrower data but lack standardized, third-party industry assessments. Leadership often flag this as a concern, especially for sectors where frontline staff have limited experience or sector knowledge.

By integrating IBISWorld’s Risk Ratings into their credit frameworks, they strengthen early-stage deal assessment and portfolio review processes. The result? A more consistent view of borrower risk and greater confidence when deciding which sectors they can lean into, and those to approach with caution.

How IBISWorld insights safeguard the outcome

Let’s look at a concrete example.

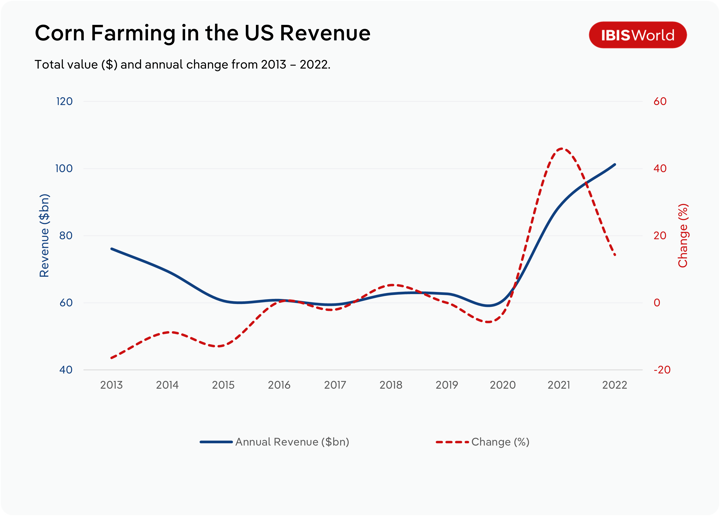

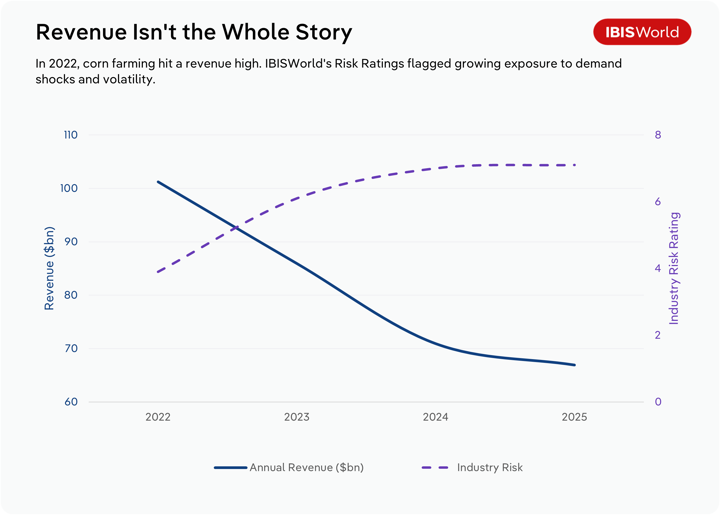

One IBISWorld client was evaluating a loan to a large operator in the Corn Farming industry in the US. The borrower’s financials looked strong. Revenue had hit a record high in 2022, and the file passed initial checks without concern.

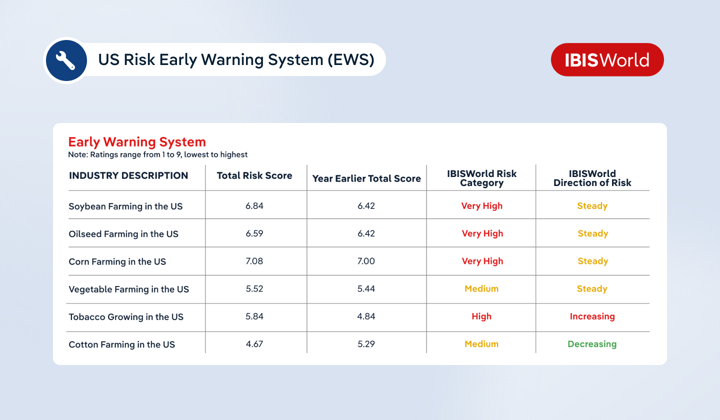

But by early 2023, IBISWorld’s Risk Ratings flagged a shift. The industry’s Risk Score had climbed sharply, reflecting heightened exposure to falling corn prices, volatile global demand and policy-driven swings in ethanol production. Despite strong financials, these external pressures were mounting, well before they showed up in the borrower’s bottom line.

Instead of proceeding as planned, the credit team restructured the deal. They tightened terms, added pricing buffers, and flagged the account for ongoing review. As revenue declined through 2023, the risk signal was validated allowing the team to avoid greater exposure and protect the portfolio.

These kinds of proactive insights are invaluable. They help underwriters prioritize which deals need closer scrutiny, support early flagging of issues before financials deteriorate, and guide how deals are priced and structured. That means fewer surprises at annual review, and more time spent on quality leads.

The value only compounds when Risk Ratings are viewed through the Structural, Growth, and Sensitivity lens, which enables lenders to understand the source of the risk. Whether it’s shrinking demand base, regulatory friction or volatile input costs, covering all the angles before financials reflect the cracks allows you to protect your long-term portfolio health.

Monitoring shifting risk and adjusting exposure

Risk isn’t static, and industry dynamics can change overnight. What looked like a safe bet last quarter may be teetering on the edge today. For underwriters, this means past approvals can become current exposure, especially if industry conditions shift faster than your monitoring cycle.

That’s why forward-thinking banks don’t just assess risk once. They track it continuously, layering external indicators into internal watchlists, credit review schedules and pricing strategies.

Get ahead of risk before it becomes a problem

After new tariffs were announced in 2025, several North American banks turned to IBISWorld. They needed to assess how trade disruptions could impact their portfolios. Through targeted sessions with our advisors, they gained clarity on key questions: Which sectors were most exposed? Which clients were vulnerable? And how should strategy, pricing, and product development shift?

From there, they took the insight a step further, which helped them adjust in real time: rebalancing their portfolio, supporting relationship managers with talking points, and flagging high-risk clients for proactive outreach. All before issues hit annual review or spiraled into larger exposures. This meant fewer fire drills, more time to focus on quality assessments, and faster alignment between teams when repricing or adjusting exposure.

Our Early Warning System goes even further. By integrating IBISWorld’s Risk Ratings via API into dashboards like Tableau or homegrown systems, banks can monitor risk trends live, not just in a spreadsheet or after the fact.

This eliminates tedious manual work, reduced stakeholder bottlenecks and gives underwriters and executives a holistic, real-time view of portfolio risk. It also helps avoid back-and-forth with deal teams by backing up your gut instincts with third-party data. This results in faster strategy pivots, smarter client outreach and fewer unpleasant surprises.

And yes—clients do use our trend lines to guide everything from watchlist and review planning. A point-in-time score is useful, but trends tell the real story: Is risk improving or worsening? Is this industry rebounding, stagnating, or heading into decline?

Surfacing these insights earlier reduces the pressure to catch everything during annual review and gives you more control over what lands on your desk. And when you build this into your oversight process, you not only protect today’s portfolio, you stay ahead of tomorrow’s risks and make room for better deals in the pipeline.

Explaining risk decisions clearly to internal stakeholders

Let’s face it—communicating risk internally can be just as hard as spotting it. Whether it’s justifying a repricing decision or pushing back on a borderline deal, you need to arm yourself with evidence. This is where having consistent, industry-level evidence makes all the difference.

One underwriter had to defend a tough call: denying additional credit to a borrower in a high Structural Risk sector. By referencing IBISWorld’s report on industry fragmentation, competitive pressures and declining profit margins, they gained fast approval from the credit committee. The data spoke for itself and avoided a drawn-out back-and-forth.

This scenario plays out often. Sales wants to close deals. Risk needs to protect the bank. And you’re caught in the middle. For underwriters like you, that means repeating the same explanations or defending decisions without backup, which slows you down and adds unnecessary stress.

When both sides speak the same language (using the same risk definitions and standardized ratings) discussions become smoother and decisions faster. Instead of debating subjective judgement, you can point to third-party ratings that explain industry risk in clear, defensible terms.

Shift the conversation with consistent risk language

Our proprietary framework gives your whole team a common ground. No one has to guess what "industry risk" means anymore. You’ve got hard numbers, standardized definitions and consistent scoring, all embedded in your workflows and accessible where and when you need them.

Our Salesforce app, for example, allows relationship managers to prescreen prospects before they reach your desk—eliminating low-quality submissions and helping you focus on stronger deals.

And when deals must be declined, IBISWorld’s data provides a compassionate, educational way to share the “why” with clients. Banks have told us their relationship managers now use this information to guide clients on how to strengthen operations, making them more loan-ready in six months’ time. The outcome is better client outcomes, smoother conversations and deeper relationships across the board.

Final Word

For credit professionals, your day is packed. Between underwriting new deals, mentoring juniors, and navigating endless email threads, you don’t have time to dig through dozens of sites or second-guess every borrower’s story.

You need clear, credible, and consistent tools that plug into your workflow and help you do your job—faster and better.

IBISWorld’s Industry Risk Ratings and Early Warning System were built for professionals like you. Whether you’re evaluating a new application, reassessing a sector or guiding a portfolio review, our data helps you reveal hidden risks before they impact financials, monitor industry shifts in real time, support decisions with credible third-party evidence, align stakeholders across departments and free up time to focus on strategic analysis—not Google searches.

When fed into Salesforce, Snowflake, nCino or our own API integrations, our tools eliminate manual lift and bring enterprise-wide consistency to risk management. Your team can act on the same playbook, your decisions are better supported, and your portfolio is healthier.

That’s how forward-looking credit teams stay one step ahead, while keeping portfolios healthy and strategic focus intact.