Key Takeaways

- Consistent revenue decline comes in two forms: structural or cyclical. An industry that exhibits either form of revenue decline is inherently weak and will have outsized influence on downstream borrowers’ fiscal capacity.

- Measuring capital investment allows credit professionals to more accurately gauge capital flows. Industries with slumping capital investment rates will have greater difficulty in repaying new debt.

- Regulatory evolution is influential across different sectors. The finance, healthcare and manufacturing sectors are heavily regulated, which generates long-term and expensive compliance costs.

The volatility of global macroeconomic conditions has heightened broader risk ratings and threatened the stability of global industries within the financial sector. Credit professionals, ranging from analysts to underwriters, are constantly gauging market risk prior to issuing a new loan to a prospective client. Some of the biggest clients serviced by credit professionals, which center around private individuals and public corporations, are intertwined within broader industries that, when in decline, can harm their credit viability.

A borrower’s financials may appear strong on paper, but if they operate in a struggling industry, their future cashflow and repayment capacity could be at risk. That’s why industry context is critical, especially in fast-moving or high-risk sectors.

To ensure a comprehensive client overview that maximizes risk analysis, credit analysts must be aware of core industry decline indicators that can accurately convey the current risk profile of a client’s adjacent industry.

These leading indicators, from consistent revenue contraction to regulatory headwinds, provide early warning signals that can strengthen application reviews and support more informed, consistent credit decisions.

Why industry decline creates credit risk

Even if an individual client may have strong fiscal conditions, broader industry decline can harm their ability to repay debts. For example, a small business looking for new funding to finance a new piece of equipment may have strong profitability, but may struggle to generate stable returns if they operate in a manufacturing industry facing global uncertainty and tariff related disruptions.

Similarly, a transport or logistics company may show healthy financials, but if the broader industry is facing fuel price volatility, wage pressure or declining freight demand, repayment risk increases.

Industry decline plays a considerable role in affecting borrowers’ overall risk profiles, as the overarching performance can directly influence individual clients’ success in the open market. When an industry is consistently in decline, it signals underlying problems that can erode revenue, delay repayments and increase the likelihood of default, regardless of how strong a borrower may appear today.

Struggling markets that are unable to finance core activities will suffer from greater default rates, driven by inability to finance existing debts amid revenue slumps. The leisure, telecommunications and health industries endured greater than 4% default rates globally underscoring the struggle with local competitors and global macroeconomic volatility.

To better navigate these changes and minimize lending risk, credit professionals should be aware of industry decline indicators. By pinpointing these data points, creditors can better analyze a prospective client’s fiscal profile earlier, and improve the quality and consistency of borrower reviews.

Leading indicators of decline

Protracted revenue contraction

The first industry decline indicator any credit analyst should prioritize is whether or not an industry has a prolonged decline in revenue. When overviewing a client’s industry, a prolonged period of revenue decline can indicate either structural issues or consumer-based fall in demand.

Industries that consistently struggle to generate revenue often face weak long-term capital prospects. For example, industries struggling to match up with vertical competition tend to have slumping revenues that make them less feasible as borrowing clients. Vertical competition refers to companies’ rivals at different stages of their supply chain, not just from other brands selling similar products. As an industry-wide example, car producers like Ford Motors consistently face vertical competitors within their auto parts manufacturing process, such as digital substitutes or foreign manufactured goods.

Credit analysts can utilize industry revenue forecasts, which measure the expected long-run performance of an industry over a set time period. Similarly, analyzing an industry's life cycle stage can provide more insight into how effectively an industry is performing compared to its national GDP. Gauging long-term economic trends can also be a good proxy for identifying prolonged industry decline, particularly across industries with high exposure to service-based competitors.

What credit analysts can do

When a credit analyst flags this indicator prior to pursuing a lending application, there are proactive strategies that can be taken to reduce the creditor’s exposure to a declining industry and strengthen the applicant’s profile assessment.

- Analyzing long-term revenue trends for the borrower’s industry over at least a decade to assess whether or not the decline is structural or cyclical in nature.

- Monitoring future revenue forecasts within a five-year period to better understand short-term projections and whether an industry has a chance at recovery.

- Pinpoint industries within the declining stage of their industry life cycle and enhance overview of their performance. If the decline stems from long-term structural issues, it’s likely that their fiscal propensity may struggle.

- Engage in direct discussion with prospective borrowers on how ingrained they are within an industry. If their performance is highly correlated with industry-wide performance, sustained revenue decline will influence borrowers’ growth prospects.

Declining capital investment

The second industry decline indicator credit analysts must emphasize in their client overview is the rate of capital investment across domestic and global markets. Capital investments provide an excellent proxy to investor confidence and can signal weakness in industry performance if there are consistent declines. When a borrower seeks new funding, the broader rate of capital investment in their industry can indicate whether the sector has strong growth potential or is losing competitiveness.

Capital investment trends can be measured using broader macroeconomic data or specific financial ratios, both of which provide insight into a prospective borrower’s operating environment.

For example, in 2024, regional venture capital investment grew to $221.7 billion in the Americas region, while falling to $62.4 billion in the European region. This underscores how regional declines across European venture capital have a cascading effect on regional industry decline. If industries’ rate of capital investment is falling, it signals a tight capital market and unfavorable conditions for creditors to pursue long-term lending projects.

Capital investment can also be measured by various financial ratios. These ratios include:

- Investment-to-revenue ratios, which measure the rate of investment in relation to overall borrower revenue. Low ratios indicate stagnant or even declining investment.

- Capex/depreciation ratios, which measure the rate of capital expenditures on equipment or property in relation to industry-wide depreciation. Low ratios signal low rates of capital investment.

- Capex/total assets ratios, which measure the rate of capital expenditures in relation to total assets owned by a borrower.

What credit analysts can do

When a credit analyst flags this indicator prior to pursuing a lending application, credit analysts can:

- Measure capital expenditure trends across a borrower’s industry. If industry-wide capital investment rates are in a slump, it signals lower returns on investment for creditors.

- Understand whether slumping capital investment is temporary or permanent. If the trend goes on for over five years, there are clear structural issues that may tie into broader industry decline.

- Analyze borrowers’ responsiveness to testing new markets or ability to maintain existing market share. Saturated declining industries offer limited investment breakthroughs, making it cost-ineffective to take on new capital.

Profit fluctuation amid rising input costs

The third industry decline indicator that proves useful for credit analysts is tracking industry-wide profitability during periods of inflation. The effects of high inflation impact any region across any industry, with profitability trends offering a key proxy for broader industry stability. When input costs spike, declining industries are forced to take a hit to their profit margin due to lack of pricing power to pass those costs down to customers.

Industry-wide profit decline is a notable signal of industry decline, since they cannot maintain a stable profit margin to finance new industry-expansive activities. Manufacturing-based industries and utility industries that are responsible for producing tangible goods have difficulty in supporting new debt, as their cost structure becomes predicated on meeting more expensive input costs. The financial industry is also impacted, as higher interest rates and external competition create larger overhead costs, such as labor and compliance expenditures, reducing industry-wide profitability. External factors like interest rates and increasing domestic competition heavily impact the rate of profit fluctuation and can exacerbate cost structure volatility.

What credit analysts can do

When a credit analyst flags this indicator, there are tangible steps that can be taken prior to pursuing a lending application:

- Compare industry profit margin to historical benchmarks and track changes over time. Declining profit margins throughout a set time period can signal reduced capacity for new debt and broader financial strain that can discourage new investment.

- Analyze prevailing investment and pricing strategies within an industry. Widespread ineffective pricing or costly investment approaches may indicate systemic challenges or industry-wide decline as opposed to isolated issues within one company.

- Evaluate existing cost drivers. Gauging the current drivers of industry cost structure benchmarks provide a clear view of the highest profit constraints and allow credit professionals to streamline their lending strategy away from high-cost industries.

- Analyze industry profit in relation to sector-wide profit. Certain sectors, such as manufacturing, have inherently lower profitability due to the wide range of operational expenses accrued within the manufacturing process.

Rapidly evolving regulatory environment

The fourth industry decline indicator centers on regulatory changes and implementation of new policies. Regulatory environments vary based on region, with industry decline predicated on the scope and cost of compliance. When new regulations are introduced, industries are forced to change compliance structures, which results in higher regulatory costs and reduced operational flexibility.

Borrowers within saturated industries and with capital-intensive cost structures, such as manufacturing companies or mining corporations, are often the most exposed. Credit analysts must stay on top of the latest policy changes at the federal and local levels, as different agencies are responsible for industry-specific regulations.

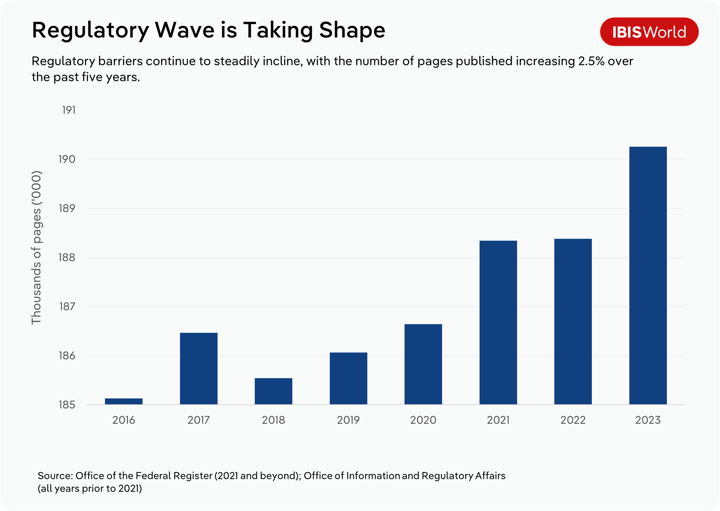

For context, the United States Code of Federal Regulations reached a record 190,260 pages in 2023, reinforcing the importance of up-to-date regulatory tracking across sectors. When effectively monitored, credit professionals can better leverage regulatory impact in negotiating lending terms with borrowers, as strictly-regulated industries will create wider overhead costs.

To support long-term risk planning, many high-income countries have adopted forward-looking regulatory strategies. In 2024, 84% of such countries in regions like the Americas and Europe published roadmaps of expected regulatory changes. If an industry is slow to adapt to these, it signals broader issues with balancing compliance costs and makes it difficult to secure new sources of funding.

What credit analysts can do

Credit professionals that flag this indicator can take concrete steps to protect portfolio exposure from heavily regulated industries, including:

- Enhancing statewide regulatory monitoring. Consistent oversight of statewide and local regulations across different regions can provide a more comprehensive overview of regulatory barriers and their subsequent costs for borrowers.

- Review sector-level exposure to industry-specific regulations. Industries with high saturation of ESG or agency-specific regulations spend more capital to maintain compliance, which eats into borrowers’ fiscal capacity for taking on new debt.

- Reassess borrowers’ financials under new policy changes. Implementation of new regulations in response to federal policies can create new compliance costs, which borrowers are forced to adapt to.

Market oversaturation

The fifth industry decline indicator involves measuring market oversaturation - a critical signal of weakening industry health and increasing competitive pressure. In oversaturated sectors, excess supply or too many competitors can drive down prices and reduce profit margins across the board.

When a borrower operates in a highly competitive industry, they may struggle to repay new debt due to tighter margins and reduced pricing flexibility. Industries with growing numbers of vertical contenders, such as the information and agriculture sectors, often experience this pressure as large numbers of market participants and relatively undifferentiated products lead to persistent price competition.

To assess market saturation, credit professionals should review the number of firms operating in the industry, pricing trends and the degree of product or service differentiation. Borrowers in low-margin, undifferentiated industries may find it harder to maintain market share or recover costs, especially when facing constant external competitive threats such as new entrants or geographic expansion.

Established industries that are inherently riskier across geographic regions have a higher chance of being oversaturated. Borrowers may be forced to look beyond incumbent geographic markets, which creates larger price competition and can undermine existing prices for core products and services. This can create prolonged industry decline, and a good example is the DVD, Game & Video Rental industry in the US where saturation pushed companies into new geographic markets — but competition remained high and long-term decline followed.

What credit analysts can do

Credit analysts that flag this indicator can:

- Conduct price analysis of borrowers relative to industry averages. Any sharp deviation in pricing means there is greater emphasis on price competition, which can undermine their fiscal availability.

- Monitor the type of market the borrower is in. Classifying whether the market is filled with competitors or has limited service differentiation is integral to determining the borrower’s ability to repay credit long-term.

- Factor price erosion into future revenue projections. If an industry is poised to endure higher price competition or entrance of new direct competitors, it may undermine their payback viability in long-run repayment deals.

Final Word

Gauging industry conditions through indicators like revenue decline, market oversaturation and profit fluctuation supports stronger borrower assessments and clearer risk identification. Credit professionals should prioritize maintaining a consistent review process that takes into account each borrower’s standing relative to their industry.

Monitoring factors like regulatory changes and national investment trends can provide a more transparent outline of what is driving industry performance – and where future risks may lie.

Spotting early industry decline can result in fewer denied applications, a more streamlined overview process and positive long-run portfolio outcomes.