Key Takeaways

- Confident expansion decisions rely on knowing when and where growth is sustainable—not just where it’s happening.

- Successful investments require a forward-looking view backed by benchmarks, demand trends and economic context.

- Strategic exits depend on recognizing market decline early and reallocating resources where long-term value remains.

Timing is everything in business – knowing when to place your hand and when to walk away. Strategic decisions like market entry, investment or exit aren’t made on gut feel alone. They require credible data, clear planning and the confidence to act.

Still, nearly six in ten CEOs say they evaluate decisions based on results, not the rigor of the process behind them. But in volatile markets, outcomes are often shaped by factors outside your control. Without a strong decision-making framework, even a good result can be more luck than logic.

Two key questions must be answered: Is the data credible? And is there enough detail to support informed decision-making?

Every industry has its peaks and troughs. What matters is understanding how well a market can adapt to change. Volatility, external drivers and shifting demand can all reshape industry outlooks – so decision-makers need reliable tools that help them stay one step ahead.

So, let’s explore how IBISWorld equips leaders with the tools to support strategic expansion, investment, and exit decisions.

How to use IBISWorld to determine when to expand into a market

Why market expansion timing matters

Expanding into a new market isn’t just about ambition – it’s about alignment. Move too early and you risk overinvestment and slow returns. Move too late and you miss the window, along with the profits.

Yet, agility isn’t easy – PwC found that while nearly four in ten CEOs entered a new sector in the past five years, only a third saw those moves contribute meaningfully to revenue. This underscores a key challenge: acting early enough to make a real impact.

While decision-makers often consider economic strength when evaluating new markets, research shows that macroeconomic attractiveness only influences entry timing when filtered through market potential. In other words, it’s not just about how big the market is – it’s about whether it’s positioned for sustainable, long-term growth.

To make the right call, leaders must distinguish between fleeting demand spikes and genuine, long-term opportunities. And that takes reliable, forward-looking insight.

What to look for

There are a number of indicators that signal when a market is on the rise. Industries that are taking off are likely to have:

- Strong profit margins: Is rising demand driving profitability, especially in industries with emerging trends or innovative technologies?

- Consistent year-over-year growth: Are steady revenue increases pointing to sustained demand and market potential?

- Active labor recruitment: Is increased hiring and business activity a sign the industry is experiencing significant growth?

- Favorable industry life cycle stage: Is the industry in a Quantity Growth phase, expanding its physical footprint, or in a Quality Growth phase, leveraging technology to boost efficiency and profitability?

These indicators help leaders prioritize sustainable growth opportunities and avoid wasting time on markets with limited long-term potential.

How IBISWorld helps

Making well-timed, strategic expansion decisions can mean the difference between market leadership and industry irrelevance. With the pressure to drive profitable growth while conserving resources, IBISWorld offers the clarity, foresight and efficiency needed to focus on industries with real, sustainable upside.

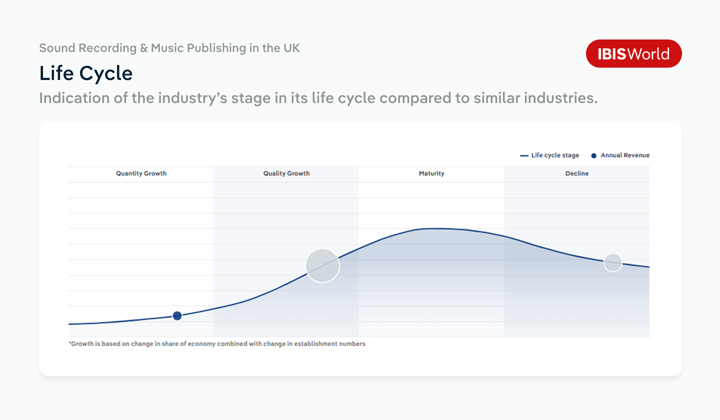

Spot growth with Life Cycle analysis

Understanding where an industry sits in its life cycle is key to timing expansion. Our Industry Life Cycle Analysis classifies industries as growing, maturing or declining, based on revenue trends, technological advancements and market saturation.

This insight allows decision-makers to direct resources toward high-growth industries with room to scale, avoiding markets with limited future potential. By visualizing where an industry is heading, businesses can confidently align their efforts with the most promising opportunities.

Pinpoint regional opportunity with State Industry Reports

For pursuing growth through geographic diversification, IBISWorld’s State Industry Reports (available exclusively for US markets) offer a top-down approach to identifying high-performing regions.

Leaders I work with use these reports to analyze national trends and pinpoint states that are outperforming due to unique demand drivers, favorable economic conditions or emerging opportunities. This level of granularity allows them to move quickly and strategically, targeting regions with the greatest potential to build a strong regional presence.

Leaders I work with use these reports to analyze national trends and pinpoint states that are outperforming due to unique demand drivers, favorable economic conditions or emerging opportunities. This level of granularity allows them to move quickly and strategically, targeting regions with the greatest potential to build a strong regional presence.

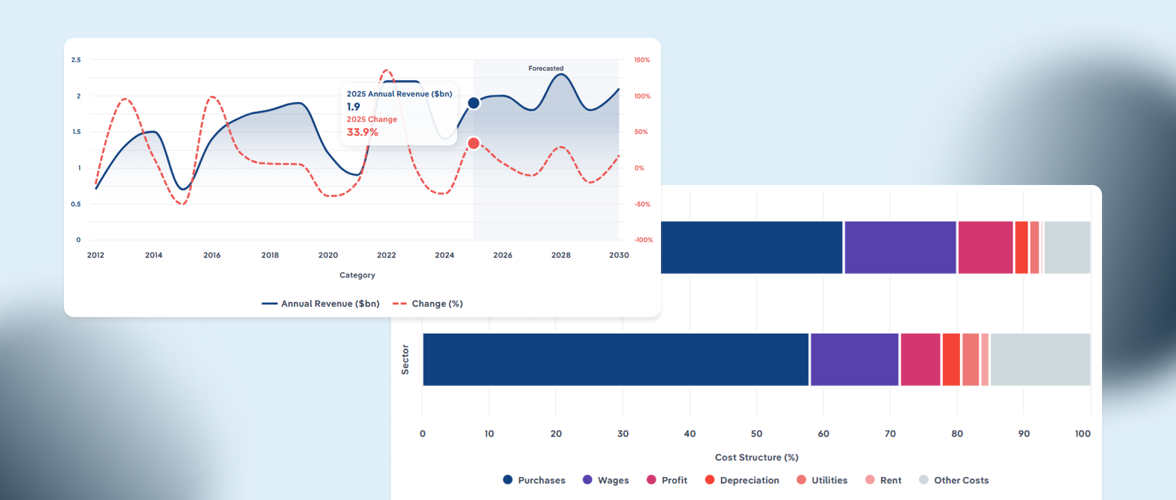

Plan ahead with growth forecasts

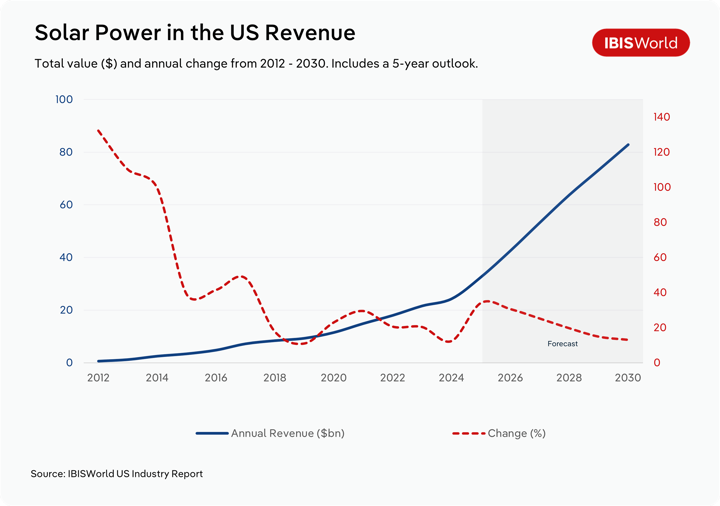

Knowing which industries are positioned to grow over the next five years is essential for setting informed growth strategies. IBISWorld’s Growth Forecasts provide clear insight on revenue projections, global expansion through trade and macroeconomic trends – filtered through an industry-specific context.

While macroeconomic strength is often a starting point, expansion decisions hinge on deeper insight. These forecasts help leaders look beyond headline indicators to identify which markets are truly primed for sustainable growth. Instead of reacting to change, they can plan for it — allocating time and capital where the upside is greatest.

How IBISWorld supports strategic market expansion

Recently, I had the pleasure of working with a long-standing US insurance company. The product development team was looking to refine the strategic direction of their portfolio by identifying domestic industries with strong growth potential. In light of ongoing tariff tensions, the team wanted to assess the potential financial impact to its manufacturing and agricultural relationships and gauge which industries are positioned to explore onshore opportunities.

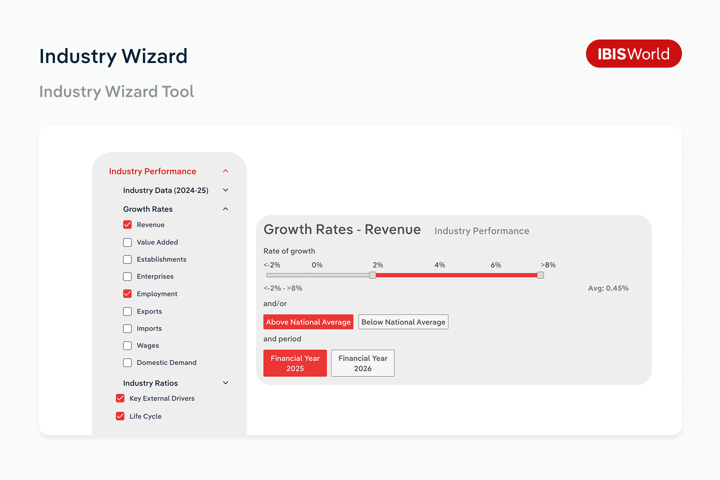

We conducted a high-level analysis on multiple industries using the Industry Wizard to gather insights on market dynamics, geographic distribution and financial benchmarks. This allowed us to filter over 1,500 industries and identify the top 20 based on exceptional growth in revenue and establishments.

From there, we leveraged State Industry Reports to segment the market by region and highlight areas outperforming national trends due to local demand drivers. We also used Growth Forecasts to illustrate performance projections over the next 3-5 years and understand the external drivers influencing demand and trade.

Instead of manually reviewing hundreds of reports, we were able to surface these insights in minutes and export them into an Excel spreadsheet to share with the firm’s leaders. This enabled the team to streamline their research workflow, build targeted queries, and align their expansion plan around markets with real, sustainable opportunity.

How to use IBISWorld to determine when to invest in a market

Why investment timing matters

Timing capital allocation wisely is crucial for those aiming to drive long-term value and secure market leadership. Poor investment timing doesn’t just risk short-term setbacks. It can lock businesses into low-growth markets, drain resources and stall momentum.

And for many leaders, the pressure is mounting. 42% of CEOs believe their company will remain viable for less than ten years if it stays on its current path. When the stakes are this high, resources must be allocated with precision and foresight.

That means going beyond surface-level signals. To build lasting value, businesses must assess market size, demand trajectory and whether their business can gain meaningful traction—identifying markets where investment will deliver sustainable, long-term returns.

What to look for

Investing wisely requires a clear understanding of whether a market is truly positioned for continuing profitability or heading toward stagnation. Businesses should assess:

- Key performance drivers: How do broader economic conditions shape industry resilience and performance?

- Market size and demand trajectory: Is demand growing sustainably or peaking prematurely?

- Risk exposure: From regulatory changes to cost shocks, what external threats could erode returns?

- Competitive positioning: Is there room to build an advantage, or will new entrants and pricing pressure shrink margins?

Smart investments decisions hinge on more than a snapshot in time. They require a forward-looking view, one that weighs not only current performance but how conditions are likely to evolve and impact returns over the long haul.

How IBISWorld helps

Making confident investment decisions requires clarity, precision and reliable data. IBISWorld equips businesses with the insights needed to prioritize high-impact investments and enhance profitability through benchmarks, business counts and key external drivers.

Assess market potential with Cost Structure Benchmarks

Understanding a potential investment’s cost structure is essential for making informed decisions. Our Cost Structure Benchmarks help businesses assess how an industry’s operating expenses, such purchases, wages and utilities, compare to sector norms.

By identifying industries with more efficient cost allocation or higher profit margins, leaders can spot businesses operating at a competitive scale. This is particularly useful when:

- Evaluating whether an industry’s profit levels can support long-term returns.

- Identifying cost pressures that may limit scalability or squeeze margins.

- Comparing potential investments to industry averages to find strong performers.

These insights help decision-makers allocate capital toward industries with sustainable operating models and avoid those burdened by rising input costs or shrinking margins.

Gauge momentum with business counts

Tracking the number of businesses in an industry is a reliable way to assess market momentum. A rising business count can signal expanding opportunity, growing investor confidence or increased consumer demand. A decline may point to market saturation, tightening margins or shifting preferences.

Our forecasts make these trends clear – helping decision-makers avoid stagnant markets and target industries where momentum is building.

By understanding how business numbers change over time, leaders can sharpen their investment strategy, allocate capital more effectively and prioritize markets that offer stronger upside.

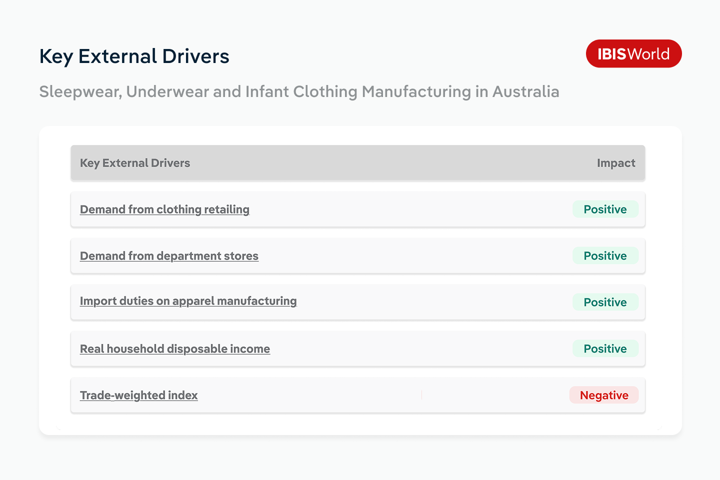

Layer in factors with Key External Drivers

Tactical investments aren’t made in a vacuum. External forces such interest rates, exchange rates, commodity prices and consumer sentiment can dramatically alter the trajectory of an industry. That’s why IBISWorld’s Key External Drivers help decision-makers understand how broader economic shifts influence industry performance at both a macro and micro level.

These drivers help businesses:

- Anticipate which external forces are likely to accelerate or dampen industry performance over time.

- Layer real-world economic context into revenue and demand forecasts, rather than relying on internal metrics alone.

- Align investment strategies with industries that are not just growing, but are supported by favorable external conditions.

From rising interest rates squeezing margins to positive consumer sentiment fueling demand spikes, these insights help leaders act early and with confidence—before macro shifts fully materialize in the market.

Take a senior decision-maker assessing the EV charging infrastructure space. With our enterprise count data, they can evaluate whether the industry is expanding, stabilizing or approaching saturation. Key External Drivers offer context on factors like government incentives, energy prices and consumer adoption, helping forecast demand. And with Performance Benchmarks, they can compare potential targets against industry averages to identify operators with scalable, efficient models.

This combination gives decision-makers a clear, forward-looking view—enabling confident investment in markets where the growth story is backed by data.

How to use IBISWorld to determine when to exit a market

Why knowing when to exit matters

Staying in a declining market is like holding on to expired coupons—no matter how many you have, they won’t do you any good. Failing to act can erode profits and drain resources, making it essential for decision-makers to recognize when an exit is necessary.

Yet many businesses delay exit decisions or avoid planning altogether. In today’s environment, that hesitation can come at a cost. In 2024, the volume of smaller and mid-sized M&A deals fell by a significant 18%, reflecting how quickly exit windows can narrow for businesses without billion-dollar valuations. Waiting too long can mean missing the opportunity to secure optimal value or being left with limited exit options.

Recognizing when to pivot or pull back is critical for preserving profitability and redirecting resources to more promising opportunities. Without timely action, businesses risk wasting valuable resources and missing out on better prospects.

What to look for

Exit decisions should be based on a mix of internal and external signals. Warning signs include:

- Declining revenue and profit margins: Are drops in revenue and profitability persistent enough to suggest the industry is losing viability?

- Rising costs: Are supply chain issues, labor shortages or inflation driving up costs and squeezing profitability?

- Regulatory changes and disruption risks: Could new regulations or technologies make it harder to sustain returns?

- Market saturation and declining demand: Is increased competition or waning interest making the market too crowded to stay profitable?

Spotting these signals early allows executives to plan their exits proactively and redeploy resources toward more promising markets.

How IBISWorld helps

When the warning signs start to stack up—shrinking margins, rising risk, or stalled demand—knowing when to step back is just as strategic as knowing when to scale up. IBISWorld equips decision-makers with the foresight to make timely, well-informed exits, thereby minimizing losses, preserving capital and uncovering stronger reinvestment opportunities.

Act early with Risk Ratings

When markets become unstable, the risks often show up in patterns before they appear in the bottom line. IBISWorld’s Risk Rating Reports help leaders assess whether a market is still worth holding onto, or if the risks now outweigh the rewards.

Each report provides a breakdown of three core risk categories:

- Structural Risk: How pressures like rivalry, cost structures, and economic volatility affect long-term stability.

- Growth Risk: Whether the industry is positioned for sustained expansion or showing signs of stagnation.

- Sensitivity Risk: How susceptible industry performance is to external shocks, such as regulatory shifts or tech disruption.

Whether it’s regulatory uncertainty, declining demand, or tightening cost structures, these insights allow executives to act before conditions deteriorate.

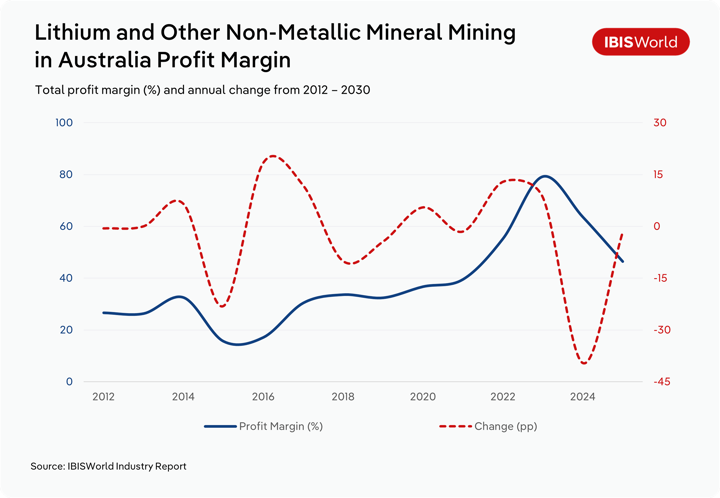

Recognize slipping value with profit margin trends

Profitability is one of the most critical aspects of long-term commercial viability. While revenue may hold steady, declining profit margins often reveal deeper issues, like cost pressures, oversaturation or weakening demand.

Our profitability metrics allow businesses to assess whether an industry is still worth the investment, or whether value is eroding.

A sharp downturn in profit margins can signal it's time to pull back – before losses compound. This data empowers leaders to reallocate resources proactively, preserve capital and explore stronger reinvestment opportunities elsewhere.

Find stronger markets with the Industry Wizard

Once the decision to exit has been made, the next question is where to go next. IBISWorld’s Industry Wizard helps redirect focus by filtering over a thousand industries based on criteria like growth trajectory, risk exposure and margin potential.

Executives can quickly identify which markets are worth re-entering, which to avoid, and how to realign their strategy around stronger opportunities—without starting from scratch. With the Wizard, decision-makers can:

- Evaluate risk and return profiles across industries to guide re-entry.

- Spot markets with rising demand, healthy margins or room to scale.

- Shortlist high-potential sectors that align with long-term strategic goals.

Final Word

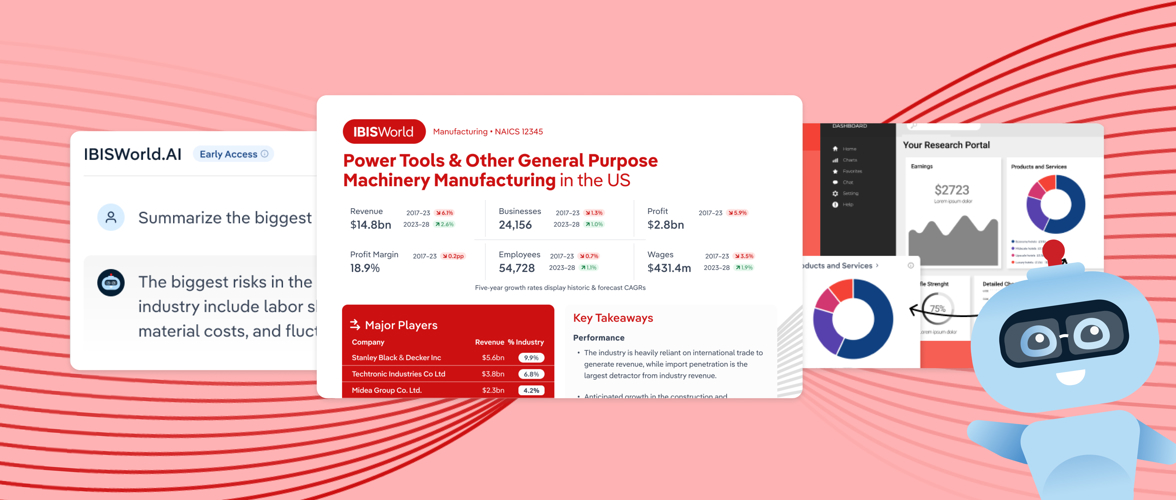

We live in the age of information, where data is essential for developing strategic frameworks that drive progress and profitability. With the rise of AI and the illusion of knowledge, IBISWorld remains a trusted resource – offering unbiased intelligence grounded in fact-finding and quality sources.

We work with clients across the globe to evaluate when to enter new markets, assess investment opportunities and identify the right time to exit. Client Relationship Managers, like myself, are here to guide you in navigating our in-depth library and tools to find your next best opportunity.

Whether you’re planning to grow, invest or exit, IBISWorld gives you the foresight to act decisively, helping you move early, move smart and move with confidence.