What is market research?

Market research (or marketing research) is the process of collecting information about your organisation’s target market. This information provides insight into your customers’ needs and preferences, which you can ultimately use to:

- improve product designs

- increase customer engagement and relations

- improve sales conversion rate

- create or update marketing strategies

Market research can also reveal opportunities and threats around your business landscape, regarding your competition and the wider market.

Why do market research?

Customers are critical to your business’s growth and success. Effectively understanding them and their relationship with your products and services therefore is essential. For example, retailers have faced changing consumer preferences to shop online as opposed to in store. While these preferences have strongly benefitted online sales, they have come at the expense of in-store sales. This trend is just one of many showcasing how operating conditions are evolving, and how vital it is for businesses to be well informed about the markets they operate in, and most importantly, the customers they sell to.

Here is where market research comes into play. It’s a way for a company to sift through all the noise, and draw on key information to make strategic business decisions and stay attentive to customers’ wants.

Reasons why research matters include:

- provides new or existing products and services with greater viability

- illuminates how your business is perceived by your target market

- determines whether a business can expand into a new market

- reveals industry or economic influences on a business

- allows your business to stay ahead of the competition

Back to online shopping: many bricks-and-mortar retailers have joined the digital movement and adopted omnichannel business strategies, including selling goods in store and online. A notable example is electronics retailer JB Hi-Fi, which has triumphed over the years online and in store. This success can be accredited to its ongoing use of market research tools such as Google Analytics, which allows users to understand what factors influence purchases and conversions among their consumers.

JB Hi-Fi, for instance, discovered that personalised product recommendations lead to higher average transaction value (ATV) – a discovery that has now led to a customer-driven business strategy. Visit any JB Hi-Fi store or its online website, and soon enough you will be met with eager-to-help staff and virtual pop-up chats. This is just one example of market research shaping an organisation.

When to do market research?

Market research is an invaluable tool that can benefit your business’s strategies. There is no set-in-stone time in which market research should be conducted. Timing varies according to your business’s needs and situation. Uber, for example, is a service still in its infancy, but is quickly pioneering the e-hailing transport market. Uber’s success can be attributed to its ongoing analysis of its consumers and transport networks.

That said, businesses typically undertake market research during one of these four critical stages in a company’s life:

1. Initiation

Data compiled while you form your business will determine which products and services you need to market, and how they should be marketed. This data will also provide a rundown on competing products, particularly regarding their price and quality, enabling you to leverage data to improve products or services and differentiate your brand. Alternatively, this research can also help you craft a product or service to break into an untapped market.

US-based e-hailing pioneer Uber Technologies, for example, saw a gap in the transport network for a more affordable, tech-savvy and convenient option. These factors led to the creation of the UberCab mobile app, seamlessly connecting consumers with drivers at an affordable price.

2. Follow up

Data collected following the ‘initiation’ stage examines the success of your company’s launched products or services i.e., their popularity among your target market. Ideally, this information allows you to modify or improve your offerings. Uber’s initial launch was limited to San Francisco, making a small splash in what was a big pool of customers. A momentous success, Uber then expanded across the United States, before going global.

3. Product launch

As your business grows, so will its product lines. Research similar to the ‘initiation’ stage will therefore be required. This data can highlight changes in your target market to improve the value of your offerings. For Uber, what began as a small car-hailing service, has catapulted into numerous service offerings, including SUVs, luxury vehicles, food and bike messenger delivers.

4. Ongoing research

Are you reaping the benefits of market research? In that case, you may opt for ongoing research. Data collected can relate to your sales, product and service deficiencies, market share and more. Uber’s internal research team continually analyse supply and demand data obtained from its Uber drivers.

How to do market research

The type of information you want to discover about your customers, competitors or a market will determine how you approach market research.

You also need to ensure the data you are collecting is lean and accurate. You can draw data from two different types of sources: primary and secondary.

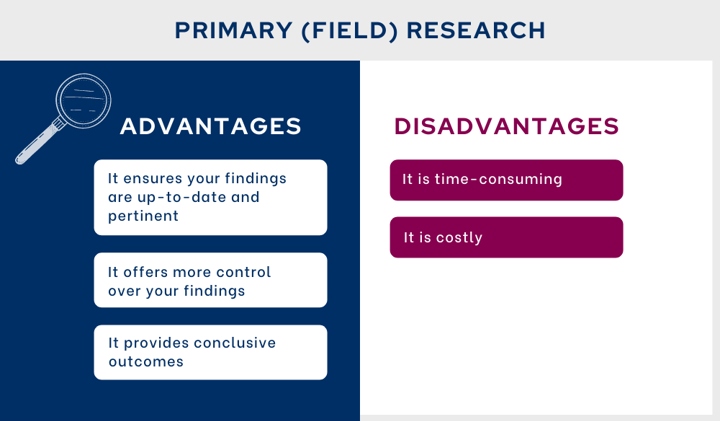

Primary (field) research

Primary research is self-initiated. This research involves going directly to a source (e.g., customers or potential clients – in other words, the ‘field’) and compiling your own original data. Examples of primary research can include surveys, direct observations, questionnaires, focus groups and interviews.

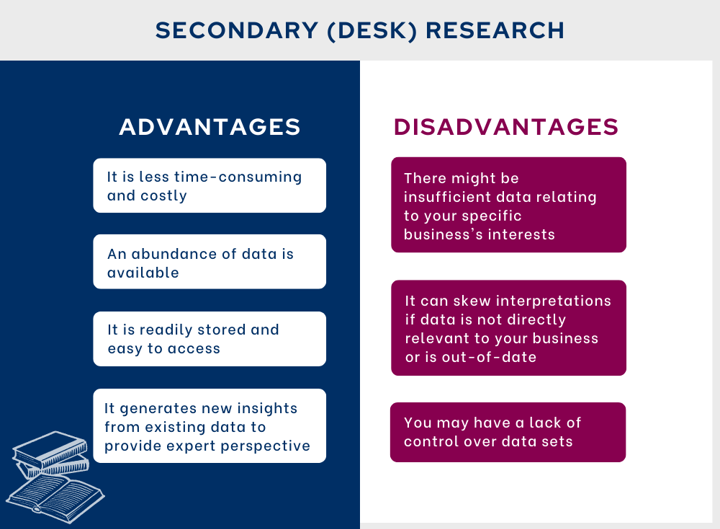

Secondary (desk) research

Secondary research pre-exists and involves drawing on data published by others (e.g., reports and studies released by researchers, government agencies, healthcare facilities, companies etc.). This type of research can essentially be conducted from your desk.

When choosing to use one of these types of sources, or a combination, ensure you consider their nature and your own limitations and decide appropriately.

Primary and Secondary research draws on both quantitative and qualitative information.

Quantitative information

Quantitative research is numerical in nature. It relates to quantifiable data, such as customer age and gender, which can help you statistically assess consumer or market trends. This research is helpful to analyse the overall landscape of your business market. This information is typically attained via surveys, questionnaires and detailed interviews.

Quantitative research can, however, narrow your findings, potentially causing you to miss the bigger picture. For example, major economic events like the GFC or the COVID-19 pandemic typically increase financial pressures for consumers. These pressures could then externally influence how inclined your target market is to invest in your products, which would distort your data.

Qualitative research

Qualitative research is non-numerical in nature – it cannot be quantified. Instead, this research measures the mental cognitions of your target market, that is their thoughts, feelings and attitudes. You can collect qualitative data by conducting focus groups and recording observations.

Qualitative information is adaptive, providing you with the luxury to tailor research around your business, and get to the nitty-gritty of how your target market perceives your products and services. More importantly, qualitative information provides additional detail about your target market, allowing you to put a face to raw data. However, analysing qualitative data can be difficult and time-consuming, and is open to bias and interpretation.

Quantitative and qualitative research provide different outcomes, and therefore should be used in tandem. Doing so will ensure you get the full picture of the data you collect. For example, if data is collected on consumer spending during a major economic event like the GFC, you could also analyse consumer sentiment or annual income data to better understand consumer behaviour.

Types of market research methods

Your business can conduct its market research in many different ways, from informal conversations with your clients to more statistical data tools, like JB Hi-Fi using Google Analytics.

Don’t feel constrained to just one approach. Instead, adopt any methods that can help draw the data you need. As the saying goes, don’t put all your eggs (i.e., trust) in the same basket (i.e., a single research method).

Three commonly used market research examples:

1. Surveys

With a clearly set out questionnaire and a targeted group of individuals, your business can effectively gather information about either (a) your products or services; or (b) your consumers’ opinions, behaviour or knowledge. Surveys are ideal for larger respondent populations, and are both inexpensive and easy to administer. They can be distributed in-person, online or via mail.

Global tech giant Apple Inc. is a key example of a company leveraging survey data. You are likely familiar with the email that follows a tech purchase that has you feeling like a VIP customer, but ends with you taking a 20-minute survey – this is Apple’s effective way of gathering insights on its target market. Apple’s in-house research team, Apple Customer Pulse, is responsible for compiling and analysing the survey results. Apple’s appreciation for market research has contributed to their reign as a front runner in consumer electronics and innovation.

While you can interpret and analyse your survey responses in many ways, cross tabulation (crosstab) is a go-to tool and the mainstay to conducting your survey. Crosstab provides side-by-side comparisons of your respondents’ answers. For example, Apple may use crosstab to compare the responses of its MacBook owners with those of its iMac desktop owners.

Crosstab shows relationships between two, or more, variables. Apple, for example, may identify a relationship between price and intent to buy, and therefore include questions about both variables in its survey. A crosstab would allow Apple to filter results to show how willing consumers are to buy products at higher prices versus at lower prices, ultimately showing how price conscious its consumers are.

To create a crosstab report, head to one of the following links:

Need help with your questionnaire? Follow one of the helpful links below:

2. Interviews

Much like surveys, interviews involve distributing a set of questions to your target audience, which can either be individuals or groups. The difference between the two is that you will need to speak directly to your respondents and record their answers yourself. Interviews either can be in-depth and formal, or short and casual. The context you want will determine how the interview is carried out i.e., by phone or in person.

Focus groups are a type of group interview that encourages interaction among participants. This method can help stimulate tangent discussion, which could either bode well or poorly for your research efforts. Generally, it takes at least three group sittings to get prevalent results.

On the upside, interviews are more personal, and can garner in-depth responses. However, interviews can be timely and costly, making them suitable for only small respondent groups. Interviews can also yield biased results if questions are not correctly mapped out.

3. Observations

Take a step back and observe. Observational research is practised in a fully immersive and interactive setting, where you observe how your target market uses or buys your products, including what barriers they hit. While this method can lack regulation and be time-consuming, if done correctly, it emits accurate and organic data to hone your products.

Observations typically take place in natural settings like stores, workplaces or homes, to best replicate how your customers normally use your products and services. Observational research is generally a last resort when all other methods fail. This method is also ideal for documenting ongoing behaviour, situations or events. For example, a retailer may want to observe its shoppers reactions to new a display in their store.

How to analyse your qualitative research results:

Analysing data from your interviews and observations can be challenging, but there are two popular methods to help you clarify responses: thematic and narrative analysis.

- Thematic analysis involves identifying common themes among respondents. You can do this via coding responses, coming up with shorthand labels (‘codes’) to your respondents’ phrases or sentences. Particularly when analysing interviews, you can use automated transcription software, which is both accurate and time effective.

- Narrative analysis involves making sense of your individual respondents’ personal life stories and experiences – identifying why your respondents act or react the way they do. For example, Apple sells products through two segments: B2C and B2B (such as the education and government sectors). During the COVID-19 pandemic, MacBook sales among both segments rose, for varying reasons. The reasons to buy MacBooks differed among consumers, some bought laptops for at-home entertainment, while businesses bought laptops for work-from-home requirements. Like thematic analysis, coding strategies are ideal for understanding and interpreting your data.

Tools

There are numerous tools available to help you map out your market research. Most commonly used include the SWOT model and Five Forces analysis templates.

1. SWOT model

Before all else, ensure you map out your company’s internal strengths (S) and weaknesses (W), and the external opportunities (O) and threats (T) in your market. This process is known as SWOT analysis – it lets you identify how your organisation is performing to support decision-making. For example, ecommerce leader Amazon uses SWOT as a pipeline to product innovation and new brand messaging.

Four elements of SWOT analysis:

Strengths are areas where your business excels and differentiates itself from your competitors. Amazon’s extensive product mix, competitive pricing and virtual domains (i.e., website and mobile apps) increase its customer reach and separate it from traditional bricks-and-mortar stores. These factors represent Amazon’s strengths.

Weaknesses are areas where your business is lacking. For example, Amazon has a limited bricks-and-mortar presence, which can deter its customers from buying products that are unfit to post.

Opportunities are untapped areas that will enhance your competitive position. Opportunities derive from your existing strengths and weaknesses. For example, an opportunity for Amazon is to expand its physical store network.

Threats are uncontrollable forces outside your business that have adverse ramifications. Like opportunities, threats stem from your internal aspects. For example, Amazon’s dominance online, while posing a strength in an era of online shopping, exposes it to the threat of cybercrime.

2. Five Forces analysis:

Knowing the ins and outs of the market you operate in is vital to determine your business strategy. For instance, you may operate in a saturated market, with many players selling homogeneous goods. However, you may find room to carve a niche sub-market and capitalise on untapped demand. You must know your competition and its influence in the market to achieve this and become profitable.

This is exactly what global sandwich chain Subway did. The fast-food market is highly competitive and saturated, where many customers are loyal to giants like McDonald’s and Dominos. However, Subway saw an opportunity to market its products to health-conscious consumers and became a global success. This highlights the importance of understanding what your competitors do (or don’t, in Subway’s case) deliver to your market, giving you the chance to succeed.

Michael Porter’s model, Porter’s Five Forces, helps you identify and analyse the forces that shape your market. This tool shows your industry’s attractiveness, regarding profitability, and how to obtain a competitive advantage.

Porter’s Five Forces:

- Threat of potential new entrants – identify your market’s barriers to entry, and other factors that could limit participation, such as rules and regulations, start-up costs, and access to suppliers and distributors. For example, the Australian fast-food industry has moderate barriers to entry. New players can enter with relative ease, as start-up costs are typically low. However, the presence of incumbent companies and the added difficulty of finding a prime location for a shopfront could deter new entrants.

- Threat of substitute goods/services – identify what other substitute products are available in your market, and their characteristics (i.e., quality, price, accessibility). This stage ensures your products or services are not like others, reducing your competition. Fast-food products, for example, can be easily substituted. Consumers may substitute unhealthy options, such as a McDonald’s burger, for a healthy sandwich from Subway. External competitors like supermarkets and grocery stores also offer substitute products for traditional fast food, such as ready-made meals.

- Rivalry among existing competitors – identify the number of competitors in your market, and how their operations affect you (i.e., do they offer competitive prices restricting your prices?). The life cycle stage of your industry can also determine the level of business entries or exits. For example, the fast-food industry is mature, as larger companies like Subway have increasingly concentrated the market. This has reduced the market’s attractiveness to new players selling comparable products, slowing business entry numbers.

- Bargaining power of suppliers – identify the number of potential suppliers in your market, and examine whether they can easily provide raw materials or change their prices. For example, Australia is home to many similar fresh and reliable produce suppliers, which diminishes their bargaining power and enables fast-food retailers to negotiate better supply terms and prices. Identifying any supplier vulnerabilities or exposures in the market can also inform resilience in your supply chains. For example, Subway has multiple suppliers, which helps insulate its inventory levels in the case of natural disasters, like floods or bushfires, disrupting produce availability.

- Bargaining power of buyers – identify the number of consumers in your market, and how they spend (i.e., size of orders, price sensitivity). For example, consumers are often swayed by the price of traditional fast food like McDonald’s and Dominos. However, for a premium or fresh alternative like Subway, they tend to be less sensitive to price.

Key Takeaways

- Set a target for you market research endeavours i.e., what do you want to obtain from the data?

- Consider your budget and information needs to determine suitable market research allocation

- Ensure your findings are clearly documented and align with your objectives

- Document actionable insights in line with research i.e., why is the data collected important to your organisation?

Are you unsure whether market research is for you? Remember to consider how highly regarded it is globally, and how influential it can be on your organisation’s success and competitiveness. From old and established entities like Apple and Subway to younger disruptors like Uber, organisations across the globe are benefiting from making market research an integrated part of their marketing efforts.