Key Takeaways

- Over 30 provisions of the Tax Cuts and Jobs Act are at risk of expiring in 2025, raising questions about the impact of potential expirations, extensions, additions and repeals

- Trump’s proposed tax policies would add trillions of dollars to the federal deficit, with some concerned that proposed tariffs won’t raise enough revenue to offset the cuts

- While tax cuts and potential repeals will benefit some sectors, others face a more mixed outlook as the economic environment becomes increasingly complex

President-elect Trump’s proposed tariff policies have received major media attention; namely a 60.0% tariff on Chinese imports, a 25.0% import tariff on the United States’ largest trading partners, Canada and Mexico, and a blanket 20.0% tariff on virtually all other imports. Its unprecedented nature and the tangible impact it would have on the US economy have captured enormous media attention, highlighting its potential to reshape international trade dynamics. However, the attention surrounding tariffs has caused many to overlook the importance of examining his proposed tax policies despite the close connection between tax cuts and tariffs in influencing economic growth and fiscal stability.

The Trump Administration’s previous tax reform, the Tax Cuts and Jobs Act (TCJA) of 2017, marked the most significant overhaul of the federal tax code in decades. It introduced significant tax reductions, lowering the corporate tax rate from 35.0% to 21.0% and reducing individual income tax rates across multiple brackets. The TCJA also added new provisions to the tax code, like the 20.0% pass-through deduction, which lowered the tax burden of millions of business owners. The TCJA’s purpose was to be a pro-growth tax policy – an environment that fosters economic expansion while making the economy more competitive – but its estimated $1 trillion to $2 trillion addition to the federal debt has been subject to ongoing criticism.

As some TCJA provisions approach expiration in December 2025, President-elect Trump has suggested that he will extend or make some of its major elements permanent. The incoming administration has also signaled support for new policies, like eliminating taxes on Social Security income and overtime pay, and repealing tax initiatives passed by the Biden Administration. With unified control of the Senate and the House, it could be easier for the Trump Administration to enact this agenda, although the lack of the supermajority (a 60-vote, filibuster-proof majority in the Senate) could hinder it. Senate Republicans would likely use a process known as budget reconciliation to push legislation through.

With the national debt already at a record high of more than $36 trillion, the potential impact of these policies on running up the debt remains a concern for fiscal stability. While these policies will continue to evolve throughout 2025 (with no formal, comprehensive legislation expected until late 2025 or early 2026), understanding how they could come to fruition is vital to responding with an adaptable strategy.

Extending the Tax Cuts and Jobs Act

What individual tax provisions of the TCJA are expiring?

The TCJA introduced individual tax provisions structured to reduce tax rates for many taxpayers and simplify tax filing by nearly doubling the standard deduction and eliminating personal exemptions. Most of these individual tax provisions from the TCJA will expire on December 31, 2025; the incoming Trump Administration has proposed that they will permanently extend many of these policies.

Marginal Tax Rates

The TCJA lowered individual tax rates, with the highest drop from 39.6% to 37.0%. Rate adjustments were aimed at reducing the tax burden across various income levels, with a notable impact on higher-income earners because of the top rate reduction. Tax brackets were also adjusted, with the income thresholds for each bracket reconfigured.

President-elect Trump has proposed that his administration will make the lower individual tax rates and adjusted tax brackets permanent past 2025. This change would reduce the overall tax burden for many taxpayers, with middle and upper-income households experiencing the most significant percentage increase in after-tax income. Maintaining lower tax rates could provide individuals with more take-home pay, encouraging consumer spending and supporting the ability to save or invest.

Standard Deductions

The TCJA doubled the standard deduction; the deduction increased to $6,000 to $12,000 for single filers, $13,000 to $24,000 for married couples filing jointly and $9,550 to $18,000 for heads of household. At the same time, the TCJA eliminated personal exemptions, which previously allowed taxpayers to deduct a set amount for themselves and their dependents. These changes substantially reduced the number of taxpayers who itemize deductions, as the higher standard deduction was more advantageous for most.

The Trump Administration is expected to maintain the higher standard deduction established by the TCJA, reducing taxable income for individuals and families. It allows millions of taxpayers to avoid itemizing deductions, maintaining the more straightforward tax process.

State and Local Taxes (SALT)

The Salt and Local Taxes (SALT) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. Before the TCJA, taxpayers could deduct the full amount of SALT paid from their federal taxable income; the TCJA placed a cap of $10,000 on this tax deduction to offset the cost of the TCJA’s tax cuts. SALT has been heavily criticized by high-tax states, including California, New York and New Jersey, who argue that the SALT cap disproportionately affects their residents.

The SALT cap will expire on December 31, 2025, unless extended or made permanent, but its future remains to be determined. President-elect Trump has signaled that he will remove or raise the cap. Still, Republican legislators have fallen on both sides of the argument, making the SALT cap a contested issue in future tax policy. Erasing the cap would result in $100 billion in lost revenue in 2025 alone, making this option unlikely, as maintaining revenues or establishing new ones is necessary to fund cuts.

What business tax provisions of the TCJA are expiring?

Corporate Tax Rates

One of the TCJA's most notable policies was the drop in the corporate tax rate to 21.0% from 35.0%. The corporate tax cut was one of the largest in US history and brought the US closer to the average corporate tax rate of other OECD countries (it was previously one of the highest).

While the corporate tax rate won’t expire in December 2025, lawmakers could adjust it when addressing other expiring provisions. Trump has suggested that he will reduce the corporate tax rate to 15.0% for companies that manufacture products in the US and has also introduced lowering the corporate income tax rate to 20.0%. This initiative aims to bolster domestic manufacturing and deter outsourcing. While the exact policies surrounding a 15.0% corporate rate are unclear, this new rate could cost over $600 billion over the next decade.

Pass-Through Income Deduction

The TCJA introduced the Qualified Business Income (QBI) deduction, which allows for deductions from pass-through business income. This deduction allows owners of pass-through businesses (partnerships, sole proprietorships, S corporations) to deduct 20.0% of their QBI when filing. The QBI deduction was introduced to ensure small companies had competitive effective tax rates compared to corporations.

President-elect Trump’s policy would maintain the QBI deduction and continue to provide tax benefits to businesses which would directly pass income to owners’ tax returns.

What new policies have been proposed?

Eliminate taxes on tipped wages, overtime and Social Security payments

President-elect Trump has expressed interest in blanket tax exemptions on overtime pay, tips and Social Security income. While the proposal could increase the disposable income of millions, it would also lead to lower tax revenues for the federal government, impacting national fiscal stability. If just overtime pay were exempt from taxes, the Tax Foundation estimates a loss of $680.4 billion in revenue over 10 years.

Create a deduction for auto loan interest

President-elect Trump has introduced a potential tax deduction for interest on car loans. Trump has yet to issue a formal proposal for this new deduction, leaving it unclear how it could be claimed and who would benefit the most. Notably, interest on car loans has doubled since 2022, expanding the net amount that could be deducted if this provision were to move forward. New car sales, which have seen steady growth since 2021, could receive a significant boost as consumers take advantage of reduced borrowing costs. An estimate from Yale University’s Budget Lab puts the cost of this deduction between $71 million and $173 million over ten years.

What existing policies could be repealed?

Electric Vehicle Tax Credit

The Biden Administration passed a $7,500 consumer tax credit for qualifying electric vehicle (EV) purchases through the Inflation Reduction Act (IRA). The credit was intended to incentivize the adoption of cleaner transportation and accelerate the transition to a low-carbon economy. A tax credit can make EVs more affordable, encouraging consumers to choose electric vehicles over traditional gasoline-powered cars.

President-elect Trump has stated his interest in repealing the tax credit for EV purchases. Removing the EV credit would make it more difficult for electric vehicles to compete with gas-powered ones. Experts suggest that this credit of the IRA is at the greatest risk of repeal.

Green energy tax breaks

The Biden Administration’s Inflation Reduction Act included tax credits between $500 billion and $1 trillion for clean energy projects. These incentives aim to accelerate the transition to renewable energy by supporting investments in technologies like solar, wind and battery storage.

While some of the IRA tax breaks are at risk, it is less likely they’ll be fully repealed. The Clean Electricity Investment Tax Credit (ITC), which offers a tax credit to investors and developers based on the investment made in eligible clean energy projects, could be phased down. Other credits, like those for companies specializing in carbon capture and hydrogen production, for example, are benefiting Republican-leaning states, creating enough Republican support to prevent a repeal.

Examining the potential impact of tax cuts on the US economy

Tax cuts, especially for corporations and high-income individuals, have the potential to boost investment and economic activity; however, they may also raise the federal deficit, potentially creating economic challenges in the long term.

How could cuts impact the federal budget?

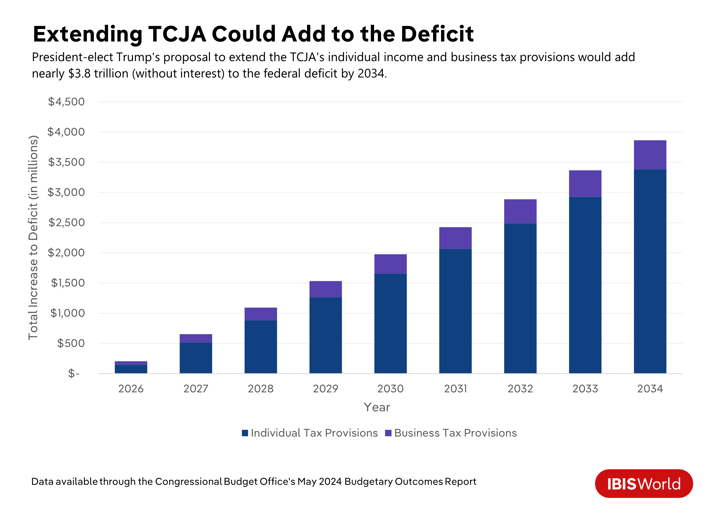

President-elect Trump’s proposal to extend the 2017 tax cuts has raised significant concerns that it could intensify the United States' budget deficit challenges. Prolonging the reduced individual and corporate tax rates would substantially drop federal revenue, especially without corresponding spending reductions or the exploration of alternative revenue sources. A Committee for a Responsible Federal Budget report estimates that extending the TCJA provisions could add, with interest, over $4.5 trillion to the deficit between 2025 and 2035.

This total doesn’t reflect the proposed additional cuts, including a 15.0% corporate tax rate and exemptions for overtime pay, tips and Social Security. These cuts would add an extra $3.8 trillion to the deficit in that same 10-year window.

Could tax cuts influence consumer spending?

Tax cuts for individual income directly increase consumers' take-home pay, which can strengthen consumer spending. Higher spending can have a ripple effect through the economy, supporting economic growth and job creation. In the short term, lower individual income taxes could strengthen consumer spending, leading to a higher consumption of goods and services. More disposable income also improves a consumer’s financial flexibility, which raises consumer confidence and encourages households to spend rather than save.

Would business investment be impacted?

The TCJA reduced the corporate tax rate permanently from 35.0% to 21.0%; President-elect Trump has suggested he will maintain this rate and potentially lower it to 15.0% for companies making products in the US. Extending its provisions could maintain this lower tax burden, enhancing corporate cashflow. With more cash on hand, businesses might have a greater capacity to invest in new projects, capital goods and tech upgrades.

Adopting a 15.0% corporate tax rate, particularly for domestic manufacturers as proposed, would significantly influence business investment. Expanding after-tax profit would enhance cash flow, enabling companies to reinvest in operations, tech and infrastructure, potentially driving productivity and job creation. A lower rate could also make domestic manufacturers more competitive globally, attracting foreign investment and encouraging domestic expansion.

What’s the relationship between tax cuts and tariffs?

The link between tax cuts and tariffs is complex, but balancing these factors ultimately decides the impact on business investment, consumer spending and the federal deficit. While tax cuts are intended to stimulate consumer spending and business investment by increasing after-tax income, tariffs function as a de facto sales tax on imports, raising prices and potentially negating the positive effects of tax cuts through inflation. Tariffs and inflationary pressures would reduce household incomes, strain consumer spending and create more cost-conscious shoppers.

Impact of Trump’s tax policies on domestic industries

A proposed cut to the corporate tax rate and the continuation of the QBI signal that the incoming Trump Administration will support an environment that is friendly to big business. Still, while some industries may benefit from tax cuts and potential repeals, the impact will play out differently across the economy.

Retail

President-elect Trump’s proposed tax policies and tariff hikes leave the retail sector with a mixed outlook. While individual tax cuts would be a favorable tailwind, many retailers may not be able to absorb the impact of tariffs on imports, especially as most are already paying higher operating costs.

Extending the individual income provisions of the TCJA would leave most consumers with more take-home pay, as a smaller portion of their earnings would go towards paying taxes. Retailers could benefit from this boost in consumer spending, as shoppers might be more willing to make discretionary purchases or upgrade their usual spending habits. A potential uptick in consumer activity can drive sales growth and improve profit for businesses in the retail sector.

Strategies for success

- Enhance loyalty programs to encourage repeat purchases and build a stable customer base.

- Leverage targeted promotions to capitalize on increased consumer spending from individual tax cuts.

- Invest in operational efficiencies to offset rising operating costs and protect profit.

Renewables

Trump has signaled his interest in repealing the $7,500 federal tax credit for EVs; this would have several implications for the renewable energy sector. Without the tax credit, EVs could become less affordable for consumers, potentially reducing adoption.

A drop in consumer demand would directly translate to reduced sales for EV manufacturers; this is especially problematic for automakers which have invested heavily in scaling EV production and developing new models, as lower sales volumes reduce their ability to achieve economies of scale. While domestic EV production has been ramping up to meet growing demand, repealing tax credits could disrupt this progress, posing challenges as automakers vie for market share in a rapidly changing landscape. Legacy US automakers, like GM and Ford, have yet to profit from their US EV sales, underscoring the financial challenges they have faced in transitioning to electric vehicles; repealing the EV credit could deepen these challenges.

The incoming Trump Administration is expected to not fully repeal the Inflation Reduction Act. Still, it could pull back on some tax credits, including those for expanding offshore wind and solar energy. Reducing or eliminating tax credits could raise costs and slow the development of renewable projects by making them less financially attractive. Investment uncertainty also could deter companies from committing to new projects, disrupting the rapid growth seen in the renewable energy sector. A slowdown would also stunt job creation and hinder progress toward environmental goals.

Strategies for success

- Expand partnerships with energy storage companies to improve the resilience and scalability of renewable projects.

- Prioritize high-return projects to maintain profitability and mitigate risks from reduced tax credits.

- Advocate for stable policy frameworks by collaborating with industry groups to support long-term investment in renewables.

Tech

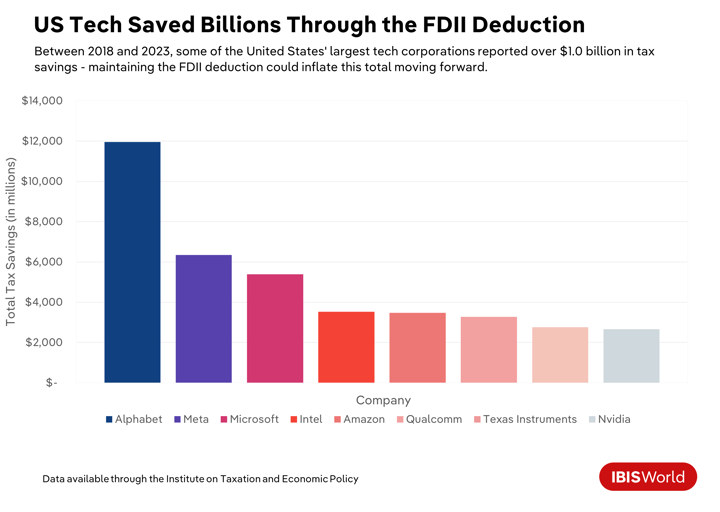

The Foreign-Derived Intangible Income (FDII) deduction was a significant tax cut included in the TCJA. The FDII deduction lowers the tax rate on US corporations that derive income from intangible assets, including patents and other forms of intellectual property. The FDII deduction has provided substantial tax advantages to the tech sector, benefiting companies with significant intellectual property holdings. Major companies, including Alphabet, Meta, Microsoft and Intel, have collectively saved billions in taxes since the provision took effect, with Alphabet alone reporting over $11 billion in tax breaks between 2018 and 2023. The FDII has also provided substantial tax breaks for pharmaceutical companies, including Moderna and Pfizer.

Maintaining the FDII, combined with a potential corporate tax rate cut, would benefit tech industries. This tax policy, if enacted, would significantly strengthen the profit and competitive position of US tech companies by creating substantial tax savings, leading to increased after-tax income. This enables reinvestment in research, innovation and acquisitions, enhancing their competitiveness. A lower tax burden also improves global competitiveness by incentivizing them to keep intellectual property domestic. Financial gains support stock performance, and shareholder returns through dividends or buybacks, consolidating their market power.

Strategies for success

- Maximize R&D investments to capitalize on FDII benefits and drive innovation in emerging technologies.

- Reallocate profit strategically to fund acquisitions and strengthen competitive market positions.

- Enhance tax compliance processes to ensure full utilization of deductions and incentives under current tax policies.

Manufacturing

An extension of the Tax Cuts and Jobs Act (TCJA) would benefit manufacturers primarily because it provides a more favorable tax environment. The TCJA lowered the corporate tax rate to 21.0%, offered a 20.0% pass-through deduction and boosted the estate tax exemption threshold. Extending these measures will reduce tax liabilities, allowing manufacturers to reinvest savings into their businesses, drive growth and maintain global competitiveness. Over 92.0% of domestic manufacturers have supported maintaining or lowering the corporate rate. Reducing corporate tax rates to 15.0% for companies producing goods domestically could significantly boost manufacturers' profit by allowing them to retain more earnings for reinvestment. This incentive encourages manufacturers to expand operations within the US, leading to expanding domestic production and potential job creation. An influx of additional capital could also drive investments in new technologies and infrastructure, enhancing efficiency and competitiveness.

How manufacturers can expense research and development (R&D) costs will also likely be addressed. Currently, businesses must spread R&D costs over several years rather than deducting the full amount of those expenses immediately. Bipartisan support leans toward changing the rules back to allow immediate expensing of R&D costs, as it makes investing in innovation more affordable and encourages businesses to spend more on R&D. While a reversal in this policy would add to the cost of tax cuts, restoring immediate expensing for R&D costs would reduce manufacturers' tax burdens, freeing up cashflow to reinvest in innovation. This change would encourage product development, strengthen competitiveness and secure financial certainty for long-term investments.

Strategies for success

- Invest in advanced manufacturing technologies to capitalize on tax savings and enhance productivity.

- Advocate for immediate R&D expensing to encourage innovation and reduce long-term tax burdens.

- Expand domestic operations to take advantage of potential incentives for US-based production and increase market share.

Final Word

President-elect Trump's proposed tax agenda focuses on the 2017 Tax Cuts and Jobs Act, introducing significant implications for the US economy and fiscal stability. Key elements include potential extensions and changes to individual and corporate tax provisions, which could add trillions to the federal deficit while impacting various industries differently.

While tax cuts may boost consumer spending and business investment, concerns about the deficit and the potential repeal of incentives for renewable energy sectors highlight challenges. This dynamic environment underscores the need to remain adaptable and strategic in response to these potential policy shifts.