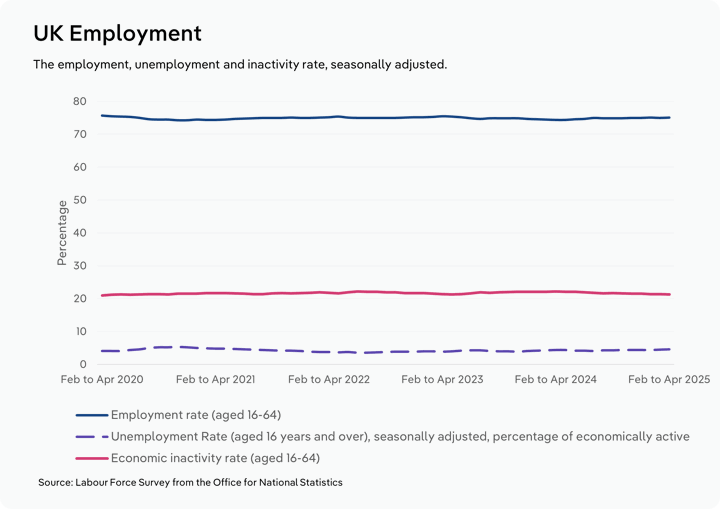

Employment in the UK is holding steady on paper, but that’s where the stability ends.

With 4.6% unemployment in early 2025, the UK might appear to be in decent shape. But behind this headline lies a fragile labour market under pressure from an ageing population, falling birth rates, and growing mismatches between available skills and vacant roles. Post-Brexit immigration reforms and rising employer costs are only intensifying the cracks.

In this white paper, Senior Industry Analyst Fiona Stalker presents a detailed diagnosis of the UK's workforce health. Drawing on the latest labour force statistics, sector-level trends and government policy updates, the paper examines why Britain’s labour shortages are not a post-COVID blip, but a long-term structural threat.

What’s in the white paper?

This in-depth report tracks the UK labour market's evolution, diagnoses current stress points and outlines the strategic risks facing both employers and policy-makers.

Structural stress in the job market

Vacancies are falling, but critical roles in construction, healthcare, hospitality and IT remain unfilled. As employer National Insurance contributions and minimum wages rise, hiring slows, even while demand in key sectors grows.

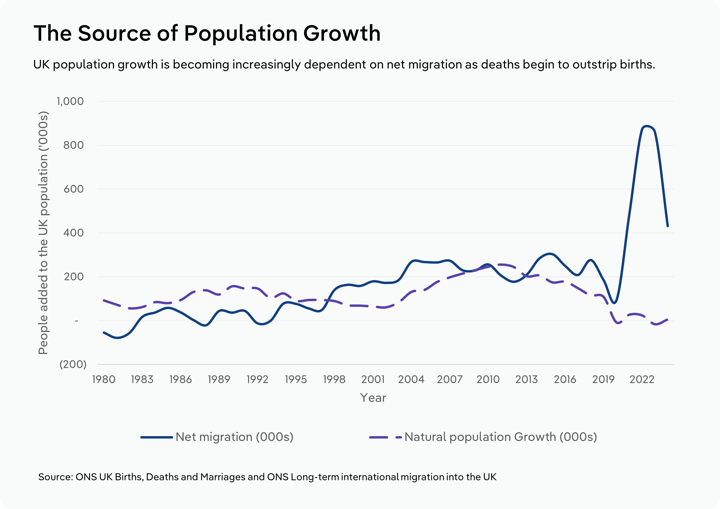

A demographic time bomb

An ageing population and declining birth rates are shrinking the working-age cohort. Without net migration, the UK’s population would decline by 2030. Older workers are retiring faster than they can be replaced, creating knowledge and skills gaps that policy alone can’t easily fix.

Brexit’s legacy, immigration’s pivot

The shift from EU to non-EU migration, and new visa restrictions in 2024 and 2025, have reduced access to workers in care, hospitality and food services—roles historically reliant on overseas labour. Meanwhile, the government’s push to reduce net migration threatens to compound shortages unless upskilling efforts accelerate.

Sector-by-sector insights

- Health and Social Care: Dependency on migrant carers and falling domestic training numbers risk long-term service gaps.

- Construction: Labour shortfalls threaten to derail housing targets and infrastructure projects.

- Manufacturing: Skills gaps, ageing workers and underinvestment in training are slowing output.

- Hospitality: Low wages and recruitment challenges threaten one of the UK’s largest employers.

- Technology: Demand for digital talent is soaring, but the UK’s training pipeline isn’t keeping pace.

Policy under pressure

While the government is investing in apprenticeships, bootcamps and workforce plans, restrictions on skilled worker visas and care visas may undermine progress, especially in sectors already on life support.

Why now?

The UK labour market is approaching an inflection point. With nearly half the workforce expected to be over 50 by 2030, the window for action is narrowing. Businesses must brace for a new era of workforce scarcity, and success will depend on how well they can adapt recruitment strategies, embrace automation, and invest in training.

This white paper offers critical context for navigating that challenge—one that will shape productivity, growth, and economic opportunity for years to come.

Final Word

This report is essential reading for professionals who rely on labour market insights to guide economic decisions, assess risk, and plan for future growth:

- Commercial lenders and underwriters assessing workforce-related risk in construction, healthcare, or hospitality loans.

- Management consultants advising clients on workforce strategy, recruitment, or business transformation.

- Corporate strategy teams navigating capacity constraints, expansion plans, or automation investment.

- Industry associations and chambers of commerce advocating for sector resilience and workforce readiness.

- HR and workforce planners forecasting talent needs and aligning internal skills with external conditions.

Whether you’re planning infrastructure, allocating funding, or helping clients grow, this paper equips you with the context needed to understand and respond to the UK’s emerging labour market crisis.