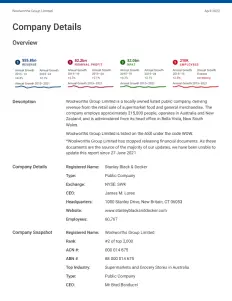

Hotel Property Investments Ltd - Australian Company Profile

Enterprise Type: Trust

ASX Code: HPI

What does Hotel Property Investments Ltd do?

HPI Group is a Trust that generates the majority of its income from the Real Estate Services industry.

In 2024 the company generated total revenue of $82,400,000 including sales and other revenue. The exact number of employees for this organisation is not available.

The Chief Executive of HPI Group is Mr Don Smith whose official title is Managing Director & Chief Executive Officer. The Chairman of HPI Group is Mr Available Not whose official title is Independent Non-Executive Chairman.

Hotel Property Investments Ltd - Competitive Environment

Industries of Operation

Competitors

- BIFM AUS Holdings Pty Ltd

- CBRE Australia Pty Limited

- CoreLogic Australia Holdings Pty Limited

- Opteon Group Holdings Limited

- Knight Frank Australia Holdings Pty Ltd

- Prudential Investment Company of Australia Pty Ltd

- McGrath Limited

- The Agency Group Australia Limited

- WOTSO Property

- Hotel Property Investments Ltd

Thousands of companies, hundreds of industries

Get strategic insights and analysis on 700+ industries in Australia and thousands of companies with an annual membership.

Get in TouchHotel Property Investments Ltd - Products & Brands

Hotel Property Investments Ltd - Key Personnel

Hotel Property Investments Ltd - Financial Statements

Hotel Property Investments Ltd Financial Profit & Loss Account

| BALANCE DATE | 06/30/2024 | 06/30/2023 | 06/30/2022 | 06/30/2021 | 06/30/2020 |

|---|---|---|---|---|---|

| Sales Revenue | 73,228.0 | 70,915.0 | 66,373.0 | 54,151.0 | 49,782.0 |

| Other Revenue | |||||

| Total Revenue | |||||

| Cost of Goods Sold | |||||

| Depreciation | |||||

| R & D Expenditure |

Looking for IBISWorld Industry Reports?

Gain strategic insight and analysis on 700+ Australian industries

(& thousands of global industries)

Enterprise Profiles - table of contents

Enterprise Details

Get a high-level overview of Hotel Property Investments Ltd, including registered business details, an enterprise synopsis, SWOT analysis and main brands and products.

Key Personnel

We outline the key personnel at Hotel Property Investments Ltd by position type and title.

Enterprise Financials

Get a full view of Hotel Property Investments Ltd’s financials, including Profit and Loss Account (Revenue, Interest, Profit and Loss, and Audit Fees) and Balance Sheet (Current Assets, Non-Current Assets, Current Liabilities, Non-Current Liabilities, Shareholders’ Equity), as well as Number of Employees, Number of Share on Issue, Market Capitalisation and Earnings per Share where available. Note: we do not provide a full financial details for all company profiles.

Growth & Ratios

Get a clearer picture of Hotel Property Investments Ltd’s performance, with key financial ratios and data on financial growth.

Operating Segments

Understand the main operating divisions of Hotel Property Investments Ltd, including Revenue and Assets under each Segment, Industries and Geographic Locations Hotel Property Investments Ltd operates in.

Competitor Benchmarking

Compare Hotel Property Investments Ltd’s financial ratios and growth to peers in their industries of operation for a clearer picture of performance.

Major Shareholders

We outline the ultimate parent and largest shareholders of Hotel Property Investments Ltd.

Subsidiaries

View a list of Hotel Property Investments Ltd’s associated companies, holding company, joint ventures and trusts, both domestic and international.

History

Find out more about the history and background of Hotel Property Investments Ltd, including founding information, past announcements, mergers and major projects.

Why buy this enterprise profile on Hotel Property Investments Ltd?

IBISWorld enterprise profiles enable you to:

- Understand a enterprise’s competitive landscape

- Identify industry trends a enterprise is exposed to

- Inform your decisions for marketing, strategy and planning

- Target key enterprise personnel

The profile on BHP Group Limited includes:

- Enterprise History and Synopsis

- Overview of Brands and Products

- Enterprise Financial Statements and Financial Ratios

- Key Enterprise Personnel

- Subsidiaries, Shareholders and Ownership Structure

- Service Providers

IBISWorld provides profiles on thousands of leading enterprises across Australia and New Zealand, as well as reports on thousands of industries around the world. Our clients rely on our information and data to stay up-to-date on business and industry trends. Our expert reports are thoroughly researched, reliable and current, enabling you to make faster, better business decisions.

Purchase to read full report

Included in Report

-

Enterprise History & Synopsis

Enterprise History & Synopsis

-

Enterprise Financial Statements

Enterprise Financial Statements

-

Financial Ratios

Financial Ratios

-

Industry Averages

Industry Averages

-

Competitive Landscape

Competitive Landscape

-

Key Enterprise Personnel

Key Enterprise Personnel

-

Subsidiaries & Ownership Structure

Subsidiaries & Ownership Structure