IBISWorld has partnered with nCino, the leading provider of intelligent best-in-class banking solutions, to deliver real-time, forward-looking insights that empower faster, smarter decisions across the commercial banking landscape.

This announcement comes on the heels of nCino’s annual nSight conference, where IBISWorld served as a sponsor and held multiple sessions on the value of industry research in the commercial loan cycle. Attendees of a product pod session, hosted by nCino’s Treeske Kluck and IBISWorld’s Josh Morozowski and Jocelyn Phillips, got a sneak preview of IBISWorld’s first integration in the nCino platform and the possibilities of their new partnership.

A partnership built for better outcomes

Credit and lending professionals are increasingly seeking solutions that enhance interconnectivity between their various systems, particularly as economic volatility demands more agile decision-making capabilities.

As one portfolio manager at the nSight event explained:

“The economy is changing rapidly, with trends like tariffs shifting all the time. We use many different systems which don't always speak to each other, but we need them to and that's our goal. More integration would allow leadership to create dashboards and reporting to make better decisions and increase oversight into our portfolio health for board reporting, especially needed in volatile times like these.”

In an environment where speed, transparency, and proactive risk detection are paramount, integrated insights help credit teams:

- Strengthen loan origination by adding industry context to client assessments.

- Streamline credit reviews with on-demand, embedded insights.

- Monitor client relationships proactively, identifying structural risks before they become problems.

- Elevate client conversations, shifting from transactional reviews to strategic guidance.

James Staddon, Head of Partnerships at IBISWorld, underlined efficiency as a top benefit:

“Partnering with nCino is a great example of how we can bring industry intelligence right to where decisions are being made. It’s all about helping banks move faster, stay informed, and make smarter calls with less friction.”

Why this matters

Evaluating creditworthiness today means looking far beyond a borrower’s balance sheet. Market volatility, labor challenges, and supply chain risk all factor into long-term viability. This partnership helps financial institutions stay ahead of these forces by embedding IBISWorld’s trusted insights into key decision points—creating a more connected, proactive approach to risk management.

As one of several strategic partnerships launched in 2025, this collaboration reflects our commitment to meeting clients where they work—bringing independent, real-time insights into the platforms that power critical decisions.

What's next?

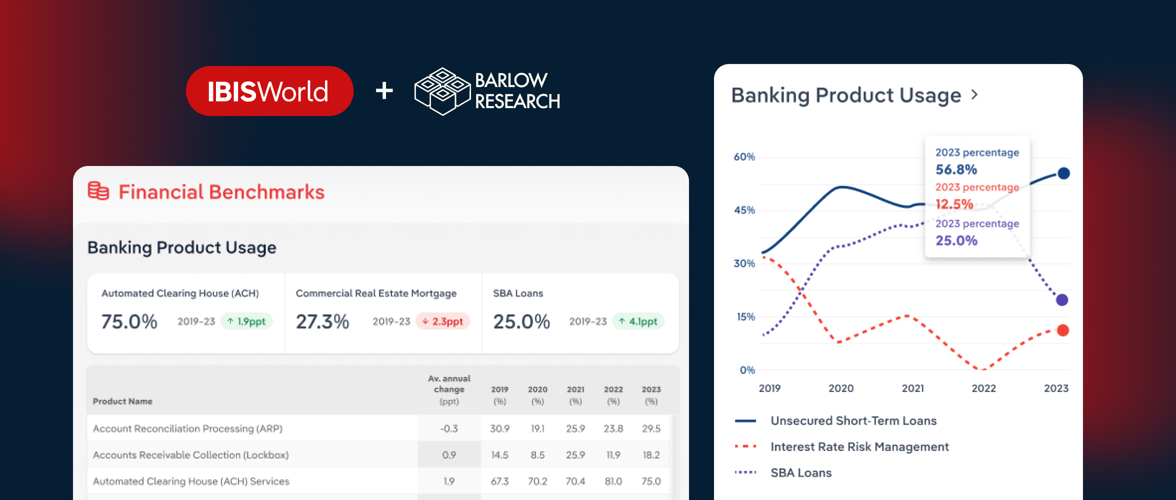

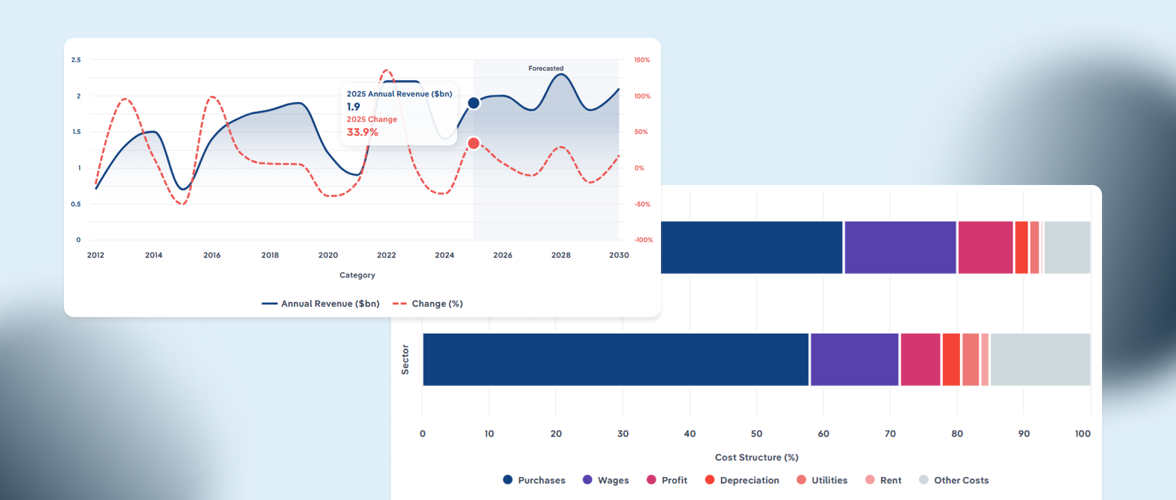

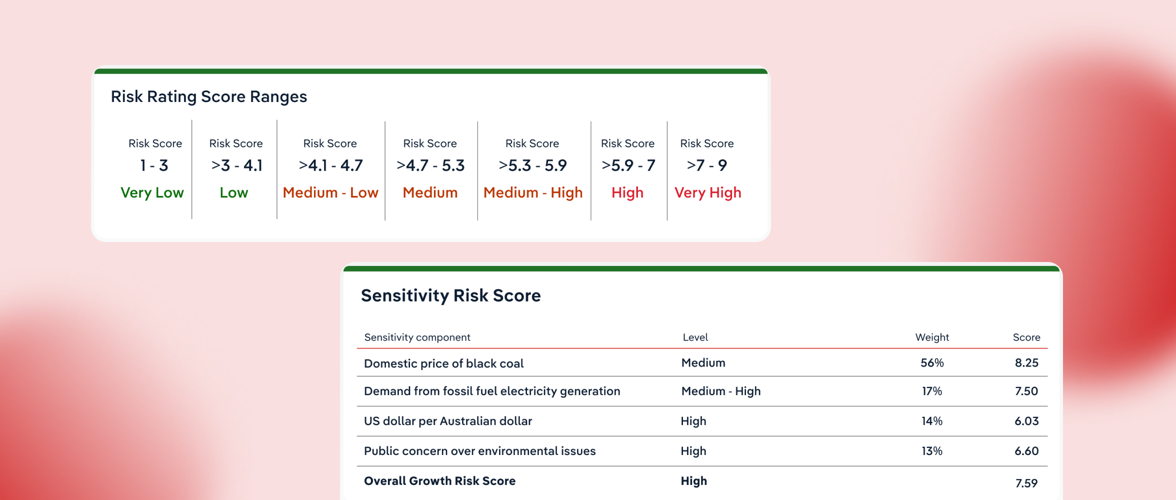

IBISWorld’s first integration with nCino is well underway, with our Risk Scores and analysis heading to nCino Continuous Credit Monitoring (CCM) first. Our risk scoring system evaluates the difficulty of operating within a specific industry, taking into account various structural, growth and sensitivity risks. IBISWorld’s best-in-class Risk Scores pair well with nCino CCM, a solution that delivers proactive alerts and detailed risk assessments to identify at-risk relationships early. Putting company- and industry-level data side-by-side, credit teams can understand the entire risk landscape:

This integration was formally announced at nSight and will soon be open to early adopters who meet both businesses’ eligibility requirements. The complete integration will progress over the next several months, with an intention to launch to a wider audience in 2026.

As the partnership progresses, IBISWorld will embed more of its industry insights across CCM and other nCino products to support more automated, data-backed decision making throughout the loan cycle.

Ready for streamlined credit monitoring?

Let’s talk! Tell us a bit about your bank’s goals and we’ll help you find the best way to implement our data directly in your workflow.